Will governmental VCM schemes be a game-changer?

Climate change is not a new topic; it’s just that in recent decades it has become a hot topic in society. Approximately 400 years before the Intergovernmental Panel on Climate Change (IPCC)—the United Nations body responsible for assessing the science related to climate change—was launched, William Shakespeare’s plays predicted a climate crisis. Pulling back to today, despite the anthropogenic skeptics and the paradox over whether renewables’ ‘green’ energy is as clean as it seems, the global temperature rise, extreme weather events and climate risks are things we cannot avoid. As efforts to combat climate change intensify globally, Luyue Tan of the London Stock Exchange Group looks at the potential role of voluntary carbon markets (VCM).

Carbon pricing – a key solution to climate change

Climate adaptation and mitigation is in the spotlight, though people may not realise how this is taking place in everyday life, or that the VCM do not only take place in far-off distant lands. Green protestors are trying their best to raise public awareness of the need to stop polluting and combat climate change, grabbing news headlines by damaging art masterpieces to call for a change of behaviour to a low-carbon lifestyle. Efforts are being made on many fronts, such as the German scientists that trained cows—animals notorious as high greenhouse gas emitters—to use a designated toilet.[1] Consumers are also taking steps, from food carbon-footprint calculation to going vegan, and only buying secondhand clothes or airplane tickets that have added offset credit fees.

However, this is not enough. Looking at the bigger picture, the bottom-up approach, starting from consumers, links corporations and the decarbonisation of industries by nation. However, it remains to be seen how countries’ nationally determined contribution (NDC) climatepledges stack up as climate risks—such as heatwaves and global temperature rises—become more frequent. It seems evident that support from carbon pricing and climate finance will be needed alongside consumer pressure for us to reach our carbon neutrality goals. The aim of a price on carbon is to incentivise emission reductions, and it is an efficient tool for boosting global climate ambitions and mitigation, from both the NDC compliance and voluntary green financing and decarbonisation approaches.

What are VCMs and why do they matter?

Carbon markets are a framework for trading carbon credits. Companies or individuals can use carbon markets to purchase credits from entities that have reduced or removed greenhouse gas emissions from the environment. A carbon credit is equal to “one tonne of carbon dioxide or the equivalent amount of a different greenhouse gas reduced, sequestered or avoided. When a credit is used to reduce, sequester, or avoid emissions, it becomes an offset and is no longer tradable.”[2] The transactions in a VCM are conducted between entities on a voluntary basis, rather than as part of a compliance emission trading system (ETS).

What governments choose to authorise in terms of carbon reduction determines the claims companies can legally make as to achieving their corporate targets. If watchdog groups and environmental organisations remain vigilant, corporates can be held to account for misleading or even lying to shareholders and the public about their climate impact.

A Guardian article in early 2023 questioned the use of carbon credits in VCMs – whether such credits are merely “greenwashing”, and could even be harmful to our planet.[3] The VCM system is currently at a crossroads, as many participants do not fully follow international and national guidelines and regulations. If implemented well, national regulations could serve as a basis for producing standardised carbon credits, both for achieving NDC targets and decarbonisation, and voluntary purposes such as labelling, environmentally friendly financing and meeting market needs.

Governmental VCM schemes – how they can be a game-changer

Indeed, government purchasing programmes would indirectly boost integrity and reliability in the burgeoning VCM for emission removals. Government policies are key to regulating the market, setting benchmarks and standardising the VCM market, while building up market confidence.

On 11th May, the European Parliament approved draft legislation banning EU companies from relying solely on carbon credits to make climate-related claims. The rules also aim to ban environmental claims that are based solely on carbon offsetting schemes. This comes as the EU looks to counter greenwashing and misleading environmental claims by targeting companies in Europe that make what it calls “unsubstantiated, unclear, ambiguous and misleading” environmental claims. The main objective of this law is to prohibit the use of terms like ‘environmentally friendly’, ‘natural’, ‘biodegradable’, ‘climate neutral’ or ‘eco’ without detailed evidence, in order to help consumers make better-informed choices.The motion received 544 votes for the legislation, with 18 against it and 17 abstentions.[4]

The global race to certify removals is gathering speed.

The European Commission published its proposal for the EU’s Carbon Removal

Certification Framework (CRCF) in late 2022, putting Europe in the lead in

carbon removal policy design. Carbon removal has

a distinct role in global climate mitigation policies, but there is a lack of

robust monitoring, reporting and verification rules for many removal

activities. Given that the CRCF would apply across Europe, this can enhance

harmonisation in a field that is still becoming increasingly fragmented.

The EU needs a trustworthy system to quantify removals so that it can achieve climate neutrality by 2050 and net negative emissions thereafter. It is only possible to scale up what can be quantified, and the scale-up of removals needs to be done especially carefully: as a complementary climate mitigation tool alongside heavily prioritised steep cuts in emissions. By building on the CRCF proposal, the EU can establish a world-leading removal certification framework that could be used as a blueprint globally.[5]

In China, the Chinese certified emissions reduction (CCER) national scheme is scheduled to relaunch this year after being suspended in 2017. A month-long open call for CCER methodologies officially ended on 30th April, meaning regulators will now be evaluating the proposals and eventually approving new methodologies under which CCERs can be issued.

Apart from CCERs, China has witnessed a boom in recent years in regional offsets. However, as with the global VCM, offset quality and greenwashing emerged as key concerns. The CCER scheme is unique in this regard, as it is linked with China’s ETS and has a better and stricter framework of credit issuances that examine the offsets’ additionality and environmental-friendliness.

With more government offsets in the pipeline, and developments in negotiations on Article 6—which governs carbon markets—of the Paris Agreement, we can see how VCM markets can be a game-changer in tackling the climate crisis.

Hammering out climate finance and capital markets’ roles

To avoid tragedy on the scale of Hamlet, it is high time we act today, instead of waiting for disaster to strike. The main consideration is how to price the scarce ‘resource’ in climate change—the limited GHG emissions in the atmosphere—and regulate it in a highly efficient way so as to avoid greenwashing. Meanwhile, the power of capital is being underestimated in blueprints for the green transition and low-carbon emissions, considering how demand for climate-related finance has surged in recent years. Using carbon funds to support the required genuinely green projects under clear policy guidelines in a global sustainable development framework will be crucial for successfully alleviating climate change.

Finding the right climate strategy is important for companies, especially the market giants. Gaining financial growth while producing through green and climate-friendly methods was once a paradox, but, with the support of consumers for eco-friendly measures, it has since shifted to a win-win scenario.

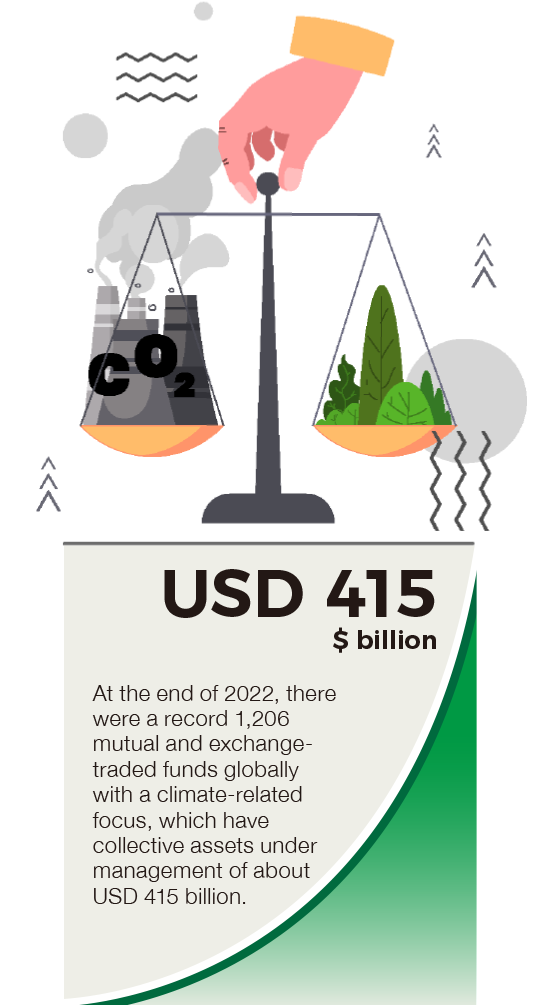

At the end of 2022, there were a record 1,206 mutual funds and exchange-traded funds globally with a climate-related focus, up from 950 at the end of 2021, according to the financial services firm Morningstar. The funds have collective assets under management of about United States dollars (USD) 415 billion. If these are used to support the other carbon pricing tools, they can brighten the gloomy outlook of limiting the global temperature rise and of humans surviving the unavoidable climate crisis.

As the old Chinese idiom goes: “Untying

the bell (on the tiger’s neck) requires the person who fastened the bell”. The

environmental and climate crisis generated by the capital markets should also

resolved by the capital itself.

[1] Cows toilet trained to reduce greenhouse gas emissions, BBC, 14th September 2021, viewed 29 May 2023, <https://www.bbc.co.uk/news/world-europe-58552651>

[2] What are carbon markets and why are they important?, United Nations Development Programme, 18th May 2022, viewed 30th May 2023, <https://climatepromise.undp.org/news-and-stories/what-are-carbon-markets-and-why-are-they-important>

[3] Patrick Greenfield, Revealed: more than 90% of rainforest carbon offsets by biggest certifier are worthless, analysis shows, The Guardian, 18th January 2023, viewed 30th May 2023, <https://www.theguardian.com/environment/2023/jan/18/revealed-forest-carbon-offsets-biggest-provider-worthless-verra-aoe>

[4] Parliament backs new rules for sustainable, durable products and no greenwashing, European Parliament, 11th May 2023, viewed 30th May 2023, <https://www.europarl.europa.eu/news/en/press-room/20230505IPR85011/parliament-backs-new-rules-for-sustainable-durable-products-and-no-greenwashing>

[5] Eve Tamme, EU Enters The Race For Carbon Removal Certification, Inside Climate Policy, viewed 30th May 2023, <https://evetamme.com/2022/11/30/eu-enters-the-race-for-carbon-removal-certification/>

Recent Comments