Discipline, anti-corruption and policy implementation

Discipline, anti-corruption and policy implementation

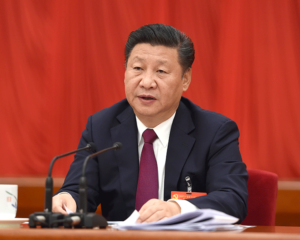

The 6th Plenum has been described predominately as an effort by the Party to elevate the status of President Xi Jinping and enshrine his administration’s anti-corruption efforts. Nicholas Consonery, Kevin Ma, and Peter Folland, political risk and strategic communications professionals at FTI Consulting, provide detailed analysis of the plenum and conclude by laying out the likely implications for foreign business in China.

In discussing the Central Committee of the Chinese Communist Party’s (CCP’s) sixth plenary session (6th Plenum), an editorial in the CCP journal Qiushi stated that it was about making anti-corruption work a “permanent course of action” and that while “some call the current anti-corruption efforts ‘a storm’, the storm will never pass.”

During the plenum, which took place in late October 2016, the leadership promulgated new regulations on how the Party supervises and governs itself. These regulations subject officials throughout the bureaucracy to greater and more regular disciplinary inspections and checks. They also empower the Central Commission for Discipline Inspection (CCDI), which oversees internal supervision within the Party, at the local levels by solidifying a shift wherein local CCDI staff report to their superiors in the CCDI instead of reporting to local-level political officials (who would have obvious incentive to shape their findings).

The plenum also amended long-standing guiding principles on Inner-Party Political Life, a crucial governing document that was put in place in 1980, which commits to collective, consensus-based decision-making. The newly amended principles strongly recommit to the collective leadership model. But they also say that decisions need to be carried out once made: they call on Party officials to “unswervingly implement the Party’s basic line”, for example, and to “uphold the Party Central Committee’s centralised and unified leadership”.

Significantly, the CCP also gave Xi the official designation of ‘core’ leader at the plenum – an honorific given, perhaps in a more qualified sense, to previous presidents Deng Xiaoping and Jiang Zemin, as well as retrospectively to Chairman Mao, with previous president Hu Jintao the notable exclusion.

The plenum’s focus on anti-corruption and Party governance is not surprising. It is widely understood that Xi’s first term has been about cleaning up corruption in the CCP and refocusing the Party on its ideological roots. Internal politics were also always going to be on the agenda for this particular event. As Chris Johnson and Scott Kennedy at the Center for Strategic and International Studies in Washington DC pointed out in a piece discussing the plenum, “the Sixth Plenum of each party administration typically focuses on some issue related to culture or ideological matters.”

So while it is important to try to understand the Party’s signalling, it is also important to try and differentiate between routine matters of governance and genuinely new or interesting political developments.

And on that front we think there is a bit more to the story of the 6th Plenum. In our reading of the event, the plenum was not just about anti-corruption itself. The Xi administration is also working to use all instruments at its disposal to force implementation of intended policy changes at the local level. This includes compliance with anti-corruption work, but also with the broader set of policies the Party is pursuing. To the extent that President Xi and his team are successful in strengthening their hand, this could actually be positive for economic reform.

And on that front we think there is a bit more to the story of the 6th Plenum. In our reading of the event, the plenum was not just about anti-corruption itself. The Xi administration is also working to use all instruments at its disposal to force implementation of intended policy changes at the local level. This includes compliance with anti-corruption work, but also with the broader set of policies the Party is pursuing. To the extent that President Xi and his team are successful in strengthening their hand, this could actually be positive for economic reform.

The new documents issued at the plenum lay the groundwork for this. The supervision regulations argue, for example, that Party officials must “ensure the Party’s organisation adequately fulfils its functions”. They also call for “strict compliance with direction throughout the whole Party” and state that “individual Party members must obey the organisation and lower authorities must obey higher authorities”.

In discussing the plenum, the overseas version of the Party’s newspaper, the People’s Daily, drew these conclusions: “While vigorously advancing the anti-corruption campaign, the top authorities have also paid great attention to some officials’ inaction. Since some officials have chosen to be ‘lazy’ to avoid committing ‘mistakes’ and being caught in the act, the authorities should strengthen the anti-corruption measures to identify the guilty and bring them to book.”

In other words, the leadership is solidifying its ability to hold officials accountable when they do not comply with intended reforms.

In arguing that “Party organisations at higher levels should be more responsible for organisations at lower levels” the new supervision regulations also issue a not-so-subtle hint that the leadership will be looking to hold higher-level officials and organs responsible for continuing anti-corruption problems or lacking policy implementation by individuals or bodies underneath their purview.

In short, we see a leadership team that is working on improving its own ability to govern as it heads into its second term.

For foreign companies doing business in or with China, the question this raises is…to what ends?

It was at an earlier plenum, the third of the 18th Central Committee in November 2013, where Xi’s team laid out a bold set of commitments to economic reform – the Decision. This widely-discussed third plenum agenda raised hopes in the business community that the Chinese Government would take meaningful steps toward more consumer-driven, sustainable, market-based growth. An ideal outcome would have seen Xi’s government moving quickly towards addressing key concerns of the foreign business community, such as opening new sectors to foreign investment, reducing policy support for state-owned enterprises (SOEs), meaningfully cutting excess production capacity in a number of sectors and better protecting intellectual property.

To be fair, some progress has been made on each of these areas over the past three years. The government rolled out a set of new free trade zones, for example, and is experimenting with intellectual property rights courts. It has also been pressing local governments and industry for production capacity cuts, even if implementation has disappointed.

To be fair, some progress has been made on each of these areas over the past three years. The government rolled out a set of new free trade zones, for example, and is experimenting with intellectual property rights courts. It has also been pressing local governments and industry for production capacity cuts, even if implementation has disappointed.

But foreign firms would like to see more – the European Chamber of Commerce’s Business Confidence Survey 2016 reported a “deepening disillusionment in China’s reform agenda” among its members, for example. Instead, as Chinese investment has continued to flood into western countries this year, there has been increased anxiety at the lack of opening up of vast sectors of the Chinese economy to foreign investors.

Unless new sectors are opened in China and progress is made on improving the foreign investment environment, it is quite likely that pushback to Chinese multinational companies’ (MNCs’) takeovers in the West will continue: the German Government, for example, reopened its review last month of a EUR 670 million Chinese acquisition of German chip-equipment manufacturer Aixtron; and ChemChina’s USD 44 billion offer for Syngenta is still under review, with European and US regulators delaying the deal following concerns raised by rival mergers in the global agricultural products sector.

That Xi’s government is using one of its two major political conclaves for the year (the other being the annual meetings of China’s top legislative and consultative bodies – the National People’s Congress and the Chinese People’s Political Consultative Conference) to try to streamline decision-making and improve the outlook for governance is no accident and should be viewed positively. These are the latest in a series of moves to do so, following a widely-discussed article in the People’s Daily earlier this year where an anonymous advisor—obviously close to Xi—sharply derided local governments and officials for their inability or refusal to push forward needed economic reform efforts.

Taken together, the 6th Plenum put Xi in a stronger position, entrenched anti-corruption work and gave Beijing a bit more muscle to push for local compliance of intended policy changes. Below we highlight the implications of these developments for MNCs in the China market:

Implications for Business

- The leadership is hoping to sustain anti-corruption work beyond next year’s leadership transition and into Xi’s second term as Party chairman (which starts at the kickoff of the 19th Party Congress next autumn and will showcase the anointment of a new leadership team). For MNCs, the plenum’s focus on entrenching anti-corruption work means that the ongoing scrutiny of them from central and local regulators will not let up.

- Expect policymakers to continue to be wary of meetings with MNCs in this climate. Following the 6th Plenum there will be an even greater emphasis than before on making sure that Party members uphold the Party’s constitution and internal regulations. The CCDI will be further empowered to examine behaviour and oversee policy compliance. Policymakers subsequently will be extra keen to toe the party line, and will be cautious and risk averse in dealing with the private sector.

- Anti-corruption work will also mean continued risk aversion by SOEs and regulators in approving new investments or business ventures. This is likely to continue to impact Chinese business partners of foreign companies operating in China, who are not going to want to make decisions without an immense level of due diligence and oversight.

- This will be strongly exhibited by SOEs, where the Party is elevating its role and its oversight functions. Expect greater caution from SOEs when negotiating with foreign companies on a widespread number of business deals and collaboration.

- President Xi’s elevation as ‘core’ leader is backed by his commitments to restore national greatness – which has included a set of more assertive defence and foreign policies. Particularly with the uncertainty around the surprise election of Donald Trump, geopolitical risks to bilateral relationships will remain elevated – including to the crucial relationship with the US.

- Keep an eye out for the leadership’s economic reform agenda as Xi’s second term approaches. The leadership has made many good commitments but so far underachieved in the way of follow through. Xi’s second term, where he will be in a stronger position to implement change, may be a brighter period on the economic reform front.

FTI Consulting is an independent global business advisory firm dedicated to helping organizations manage change, mitigate risk and resolve disputes: financial, legal, operational, political & regulatory, reputational and transactional. FTI delivers an unmatched combination of breadth and depth of expertise across a worldwide network of more than 4,600 employees located in 29 countries on six continents. To find out more, please visit www.fticonsulting.com.

Recent Comments