Business risk management in the era of COVID-19

With no end to the COVID-19 pandemic in sight, companies continue to face significant operational, financial and strategic challenges. As countries restart their economies, businesses need to effectively manage their liquidity to survive this difficult period. However, Ines Liu of Dezan Shira also warns firms to maintain vigilance, as such times of economic turmoil are when most businesses become vulnerable to acts of fraud.

In the era of COVID-19, when employees are troubled by travel restrictions and working-from-home (WFH) is the new normal, multinational companies (MNCs) are finding themselves particularly exposed to the risk of fraud. It is thus more critical than ever for MNCs to assess possible fraudulent risks within their organisation in order to see through fraudsters’ schemes in advance.

Fraud triangle in the context of COVID-19

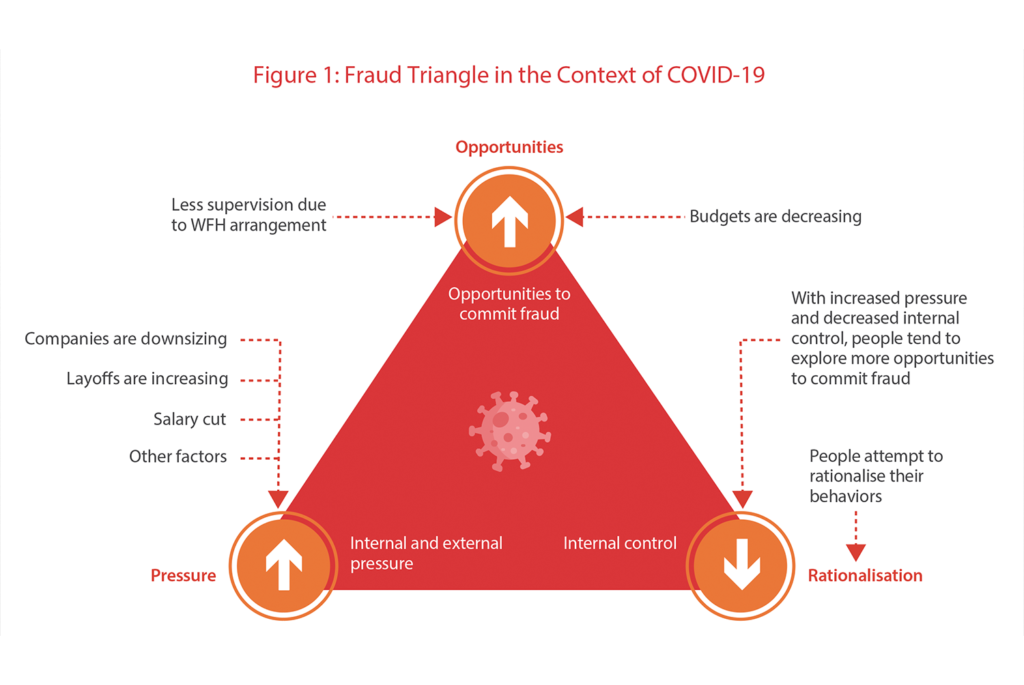

The ‘fraud triangle’ in Figure 1 shows the three elements involved when fraud is committed; pressure, opportunity and rationalisation.

Internal and external pressure

Many people have either lost their jobs or have had their salary cut since the outbreak of the coronavirus. Financial pressures on families will increase with the expected further downturn of the global economy. This may create or increase motivation to commit fraud, and may have an impact on the ability of a business to survive during a prolonged public health crisis.

Opportunities

Due to WFH arrangements and travel restrictions, many key business functions are presently understaffed or lack supervision. This especially is the case when switching or onboarding third parties (suppliers, customers and so on), as screening processes are often not carried out in full or effectively. Opportunists may take advantage of these circumstance to manipulate the process of supplier selection and pricing.

Rationalisation

With increased pressure and decreased internal control, it is easier for fraudsters to use their physical, mental or financial hardship to justify their unethical behaviour.

Key observations on fraud schemes in the context of COVID-19

Given the increase of fraudulent activities under COVID-19, it is essential for MNCs to conduct a fraud risk self-assessment and identify the most exposed areas in order to improve the firm’s resilience level. Meanwhile, employees should be informed of ways to protect themselves and their company from such risks.

Below, we list some of the top COVID-19-related fraud schemes that employees or vendors may commit, as well as suggestions of preemptive precautions and solutions.

Common instances of fraudulent activity

Procurement fraud

The forms of fraud risks different companies are subject to will of course vary. Take for example, trading and manufacturing companies sourcing from China. These companies are advised to pay closer attention to their purchase and payment systems, because the sourcing team and local management are most prone to collude with suppliers if given bribes. Local members of the sourcing team may also select companies operated by friends and relatives as preferred suppliers. These instances of conflict of interest are extremely common in China, and the current COVID-19-induced economic crisis may provide further impetus to indulge in fraudulent activities. Under such circumstances, MNCs should strengthen the control and supervision of the supplier selection and pricing process. More specifically, to combat the risk of bribes and collusion with suppliers, companies should assign different steps of the purchasing process to different members of staff, and launch an investigation if there are discrepancies in the pricing of goods and services as handled by different members.

Cash theft

MNCs with a lean China team should pay attention to the proper segregation of duties, especially for the issuance of cash receipts and cash disbursement. If the initiation and approval of e-banking payments are controlled by the same person, or if one individual holds both the company chops/official stamps and the corporate cheque book, there is a real risk of cash theft. Similarly, if the company does not segregate accounting and cashier duties properly, the accuracy and completeness of revenue expenditure and capital expenditure records can be jeopardised, which could lead to fraudulent disbursements or other forms of economic crime.

Falsification of expense claims

Conversely, companies with large China teams should carefully monitor the local payroll system, or they might be subject to fraudulent payroll and reimbursement schemes. If the general manager is colluding with or bypassing the human resources team on payroll matters, they could channel money to their personal bank account by making up ‘ghost employees’ or issuing fictitious bonuses. If the headcount is large and payroll figures significant, it could be difficult to spot this type of fraud. Likewise, opportunistic employees may take advantage of the low supervision level to increase their personal remuneration by overstating their work-related expenses.

Suggestions to reduce risk exposure and solutions

Segregating duties

The segregation of duties is essential to limit the incidence of cash theft. Initiation and approval of e-banking requests should be segregated to different employees. One practical solution could be that the finance manager at headquarters holds the e-banking token required to approve local payments.

The cashier holding the corporate cheque book should not have free access to the company chops, otherwise they will have opportunities to initiate payments at the bank without being detected. Likewise, to ensure that all bank transactions and cash movements are properly recorded, the cashier and bookkeeper should not be the same person.

Additionally, businesses should record any item shipped out with the relevant invoice, to avoid back-channel sales profiting individuals rather than the company. The consistency between inventory data, shipping records, invoicing and the sales figures in the company books should be carefully monitored, and the relevant duties appropriately segregated.

Ensuring supervision by building an effective and clear reporting line

Lured by the benefits of a leaner and more efficient decision-making structure, foreign businesses in China often entrust considerable authority to a sole employee – usually the legal representative, which paves the way for a loss of transparency and control. When an employee can perform important duties without supervision, there is always a risk he/she will end up abusing their power and acting upon self-interest.

In terms of sales pricing, the price ranges for different products should be firmly set. For businesses that rely on their sales teams to bring in new customers, it is important to set an internal policy in this regard; some products or services might have a set price, while others are negotiable.

In the latter case, there should be a clear price boundary within which employees can sell a given product or service, whether it is a certain range for all sales or a set of different ranges based on the quantity sold. And if there is a need to proceed with a sale price outside the pre-decided range, the sales team should be required to get additional approval from a senior manager in advance. This will reduce the risk of cash theft or collusion with customers.

Re-checking the inventory management system

Implementing internal controls on inventory management is essential. For trading and manufacturing companies, it is critical to implement proper information technology systems to monitor and automate inventory management.

While an automated warehouse management system significantly reduces the risk of inventory misappropriation, physical stock counts should also be performed periodically to verify the accuracy of the electronic data.

It is also essential to appropriately segregate duties between the purchasing manager and the warehouse manager, to limit the risk of collusion with suppliers by a sole decision-maker. There should be a clear reporting line defined, whereby the warehouse manager instructs the purchasing manager to place new orders with suppliers. No orders should be made without receiving authorisation from a senior manager.

Conclusion

To mitigate potential business management risks associated with the COVID-19 pandemic, all companies in China are advised to develop a thorough internal control mechanism, and periodically review their procedures to ensure the effectiveness of the system over time.

Meanwhile, fraud prevention programmes must also be backed by training delivered to local teams, so that the tone from the top trickles down to the operational level and that the China-based employees are aware of the company’s code of good conduct.

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. With more than 28 years of on-the-ground experience and a large team of lawyers, tax experts and auditors, in addition to researchers and business analysts, we are your partner for growth in Asia.

For further information, please email ines.liu@dezshira.com or visit www.dezshira.com

Recent Comments