Asian regional and Chinese equity markets outlook for 2021 and beyond

Asia’s relatively effective pandemic control in 2020 has enabled a gradual normalisation of domestic demand. The region remains the engine of global growth, powered by best-in-class COVID-19 management that allowed a swift re-opening of the industrial sector. Zhikai Chen,head of Asian Equities, and David Choa,head of Greater China Equities at BNP Paribas Asset Management, believe this trend will continue and strengthen in 2021 as vaccination programmes enable further normalisation.

Asia is rebounding strongly from 2020’s pandemic-induced crisis, which lends a positive outlook for equities in the region. Here are the main points to note:

- Asian equities had a stellar 2020, with the MSCI All Country Asia ex-Japan index outperforming both the MSCI US and MSCI Emerging Markets indices. The mainland China, Taiwan and South Korea markets did particularly well, supported by better control of the pandemic, while ASEAN members and India faced longer lockdown conditions and slower tourism. The gradual recovery will likely continue to be led by North Asia, while the rest of the region catches up.

- China in particular was one of the world’s most resilient economies in 2020. Decisive lockdown and policy measures enabled a quick, broad-based recovery, which translated into stronger earnings growth and one of the best equity returns in 2020.

- Asia remains the engine of global growth, helped by the emergence of significant intra-Asia trade that is helping the region to resist the downdraft from recovering, but slower-paced, global activity.

- The unprecedented fiscal and monetary stimulus to combat the economic downturn has been very supportive. Chinese policymakers are likely to gradually normalise fiscal and monetary policies while continuing structural reforms and opening financial markets further.

- Last but certainly not least, environmental sustainability is now a priority.

Key risks include COVID-19 developments, concerns over increasing debt levels and China-United States (US) tensions. Although technology is expected to remain a sticking point in the China-US relationship, there will be less uncertainty and risk in broader bilateral relations. The Biden Administration is expected to adopt a more rules-based and predictable approach that should benefit both Asian and Chinese equities.

Asian equities: structural changes underway

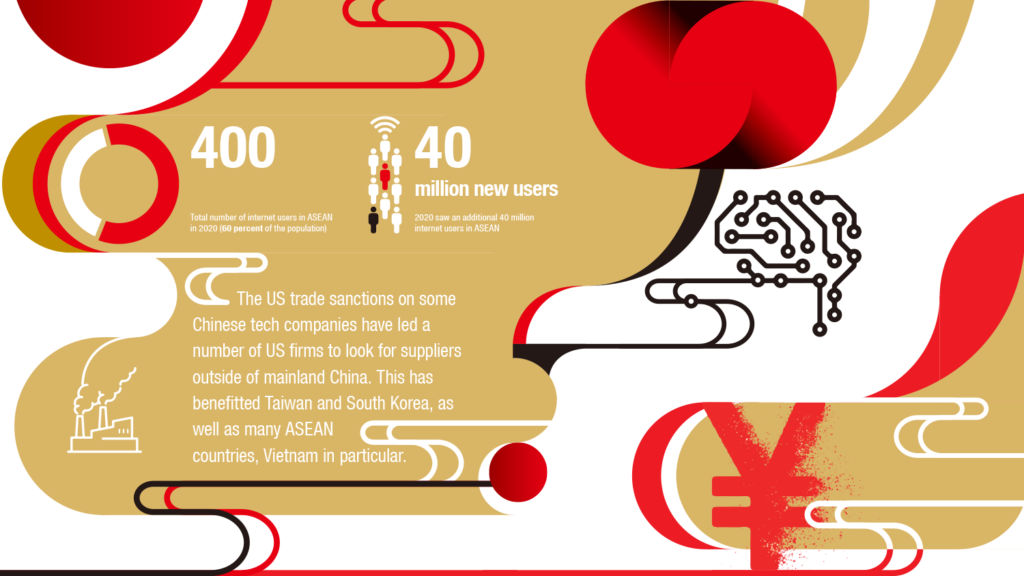

Asia has been changing structurally towards more service-orientated economies. COVID-19 has further accelerated this transformation. 2020 saw an additional 40 million internet users in ASEAN – bringing the total to about 400 million (60 per cent of the population). The new users have boosted gross merchandise value growth in home deliveries, e-commerce, video-conferencing, streaming and the financial services sectors.

Asia is witnessing a gradual relocation of global supply chains. Domestic demand-orientated fiscal stimulus under the Biden Administration should continue to pull in exports from many emerging markets, particularly Asia. The US trade sanctions on some Chinese technology companies have led a number of US firms to look for suppliers outside of mainland China. This has benefitted Taiwan and South Korea, as well as many ASEAN countries, Vietnam in particular.

Amid the competition with the US, China is deepening its ties with other regions. The recent signing of the Regional Comprehensive Economic Partnership (RCEP) is a good illustration of this. In November 2020, 15 Asia-Pacific countries—including China, Australia, Japan, South Korea and ASEAN members—signed the RCEP, which aims to provide a common platform for regional cooperation, offering a backstop for regional growth. China’s ‘dual circulation’ policy—using its internal growth impetus to drive domestic and regional growth—should support a bullish view on emerging Asian markets amid COVID-19.

Market technicals are favourable in Asia as flows, positioning and sentiment are supportive. Despite the sharp recovery in Asian stock indices, institutional investors are underweight on Asian equities given their general risk aversion and the uncertainty over Chinese technology due to US export controls on semiconductors.

Asian equity flows could improve in 2021 as vaccine rollouts revive risk appetite and a potentially less volatile China-US relationship creates better visibility on regional technology earnings.

Chinese equities: taking the driver’s seat

China remains a bright spot in 2021 after its economy was the only major one to see positive growth in 2020. This should continue, supported by three pillars: technology, sustainability and the dual circulation policy.

China was first-in and first-out of the clutches of the virus. Its recovery has been impressive, broadening from construction through to consumption and services. Chinese exports showed remarkable resilience during the pandemic, while demand for COVID-19-related products appears to be long-lasting and a broader-based recovery in other categories is emerging.

While near-term volatility could weigh on Chinese asset prices, it is unlikely to change the benign outlook given the rapid recovery and room for further stimulus. This macro-policy backdrop is supportive of Chinese asset prices in the medium-term.

The dual circulation strategy

China introduced the dual circulation concept in its 14th Five-year Plan. Dual circulation represents a policy shift towards focussing on boosting domestic growth and high-technology infrastructure investment while still engaging, but not relying on, the external sector to sustain stable growth amid the long-term strategic competition with the US.

The emphasis on the green economy, climate control and revitalising manufacturing augurs well for sectors targeted for ‘new infrastructure’ spending, technological innovation and upgrading, artificial intelligence, 5G networks, big data centres and healthcare, as well as environmental protection, water conservation projects and renewable energy.

This suggests that domestic demand growth, import substitution and technological self-sufficiency look set to be key macroeconomic factors for investment opportunities in China in the coming years.

In particular, domestic brands in technological and financial innovation, industrial consolidation and consumer upgrading will likely drive Chinese asset prices in the long term.

More structural reforms

The lifting of restrictions in domestic financial markets, accelerating reforms and the inclusion of China A-shares in major global indices are facilitating access to China’s onshore financial assets.

2020 marked the People’s Bank of China’s least interventionist currency policy stance in years. The large rally in the renminbi is expected to extend further into 2021 on the back of China’s balance of payments remaining strong and a reduction in uncertainties over tariffs under the Biden Administration.

Structural reforms should continue, such as the three-year action plan for state-owned enterprise reform through privatisation, consolidation and better corporate governance.

Note: This article is a synopsis of the BNPP AM report: Asia and China Equities 2021 Outlook in 3-D: Domestic, Digitalisation and Diversification, available on the BNPP AM website.

——————————–

BNP Paribas Asset Management (BNPP AM) is the investment management arm of BNP Paribas, one of the world’s major financial institutions. Managing EUR 483 billion in assets as at 31st December 2020, we offer a comprehensive range of active, passive and quantitative investment solutions covering a broad spectrum of asset classes and regions. With over 520 investment professionals and 500 client-servicing specialists, we serve individual, corporate and institutional investors worldwide. Since 2002, we have been a major player in the promotion and implementation of sustainable and responsible investing. We are backed by BNP Paribas, whose scale and A+ rating (by Standard & Poor’s) gives us and our clients the secure foundations to invest and make a positive difference to people’s futures.

Recent Comments