According to the EU SME Centre a number of factors have contributed to increased opportunities for European companies exporting food and beverages to China.However, they advise companies considering entering the Chinese market to do so cautiously and ensure that they fully understand how to comply with government regulations for importing pre-packaged foods.

The Chinese food and beverage market, the world’s largest grocery market in terms of revenue since 2011, has been shaken by a long list of scandals involving tainted food products in recent years. While some of these incidents have had serious repercussions for companies and consumers alike, they are having positive effects on the demand for foreign foods within China.

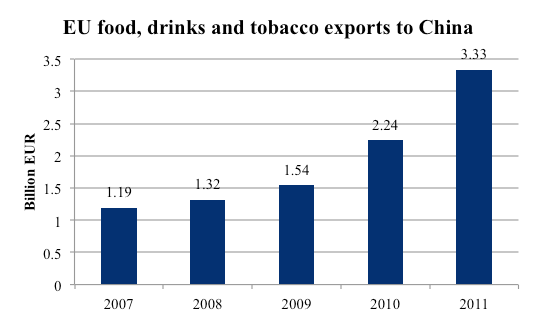

Whereas short-term fluctuations in demand do not present sustainable opportunities for European food makers looking to sell their products in China, the gradually increasing distrust of domesticall- produced food and beverages, in combination with increasing disposable income and a growing taste for foreign foodstuffs in general, is creating new opportunities for European exporters in the long run. It is thus not surprising that the value of European imports of food and drinks to China has almost tripled during the last five years.

Source: Eurostat 2013

Source: Eurostat 2013

The rising demand for imported food in China offers opportunities for the roughly 280,000 food and drink companies in Europe, but due to the multitude of regulations and authorities involved in the process of importing food into the country and the volatility of the market—brand loyalty is very low in China—entering the Chinese F&B market has to been planned carefully. Below we ask Jon Echanove, an expert specialising in Chinese import standards, a number of questions on the most important regulations concerning importing pre-packaged food into China.

Who is in charge of supervising food imports into China?

There are many different administrations in charge of importing and ensuring the quality of imports into China when it comes to food and beverages. The Ministry of Health is involved, as well as the State Administration for Industry and Commerce, the Ministry of Agriculture, the State Food and Drug Administration and the General Administration of Quality Supervision, Inspection and Quarantine of the People’s Republic of China (AQSIQ).

In March at the 2013 National People’s Congress approved the decision to create the China Food and Drug Administration (CFDA), which will replace a large group of overlapping regulators. It will combine the functions of the existing State Council’s Food Safety Office, the State Food and Drug Administration as well as the food supervision duties from the General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) and the State Administration for Industry and Commerce (SAIC). It has yet to be seen what concrete changes this move will bring about for European exporters of food and beverages into China.

Which of these organisations are European exporters likely to come across?

AQSIQ is probably the most likely point of contact between foreign importers and the Chinese authorities. They maintain 35 CIQ (China Inspection and Quarantine) centres throughout China at every major entry port responsible for commodity inspection, something most imports are subject to. They are also, through the Standards Administration of China (SAC), responsible for the development and publication of mandatory requirements concerning food safety. The technical requirements themselves might be developed by one of the other organisations mentioned above, but they are all published by SAC, which operates under the AQSIQ.

What are the most important requirements European exporters will have to meet?

The most important regulations when it comes to importing pre-packaged food into China pertain to food additives, labelling and packaging. There are also standards that regulate specific product groups like wine, olive oil or chocolate separately.

As in any other market, food products in China have to be labelled according to national standards so that consumers can easily identify the product and its contents. As a general rule, labels have to be in Chinese and list all ingredients of a product in descending order of the amounts as well as the nutritional value. The product standards mentioned above might contain additional labelling requirements as well.

Lastly, packaging might become an issue, especially if it constitutes a large portion of a product’s value, since one of the Chinese criteria for measuring excessive packaging is the cost of the packaging itself.

It has to be noted that all of the regulations mentioned above change with some frequency and occasionally without warning, so cooperating with a local partner is a big advantage when it comes to keeping up to date.

Are there any other regulations European food exporters need to be aware of?

For some pre-packaged food products, for example alcoholic beverages, a Chinese import licence is required. This licence is issued by the Ministry of Commerce and can only be acquired by Chinese entities, so exporters of those products will need to work with a Chinese importer, agent or distributor.

A relatively new regulation—effective since October 2012—requires all exporters of food products to be registered with AQSIQ. This registration must be completed by both the exporter and the Chinese importer and only shipments from registered companies will be allowed to enter the country.

Recent Comments