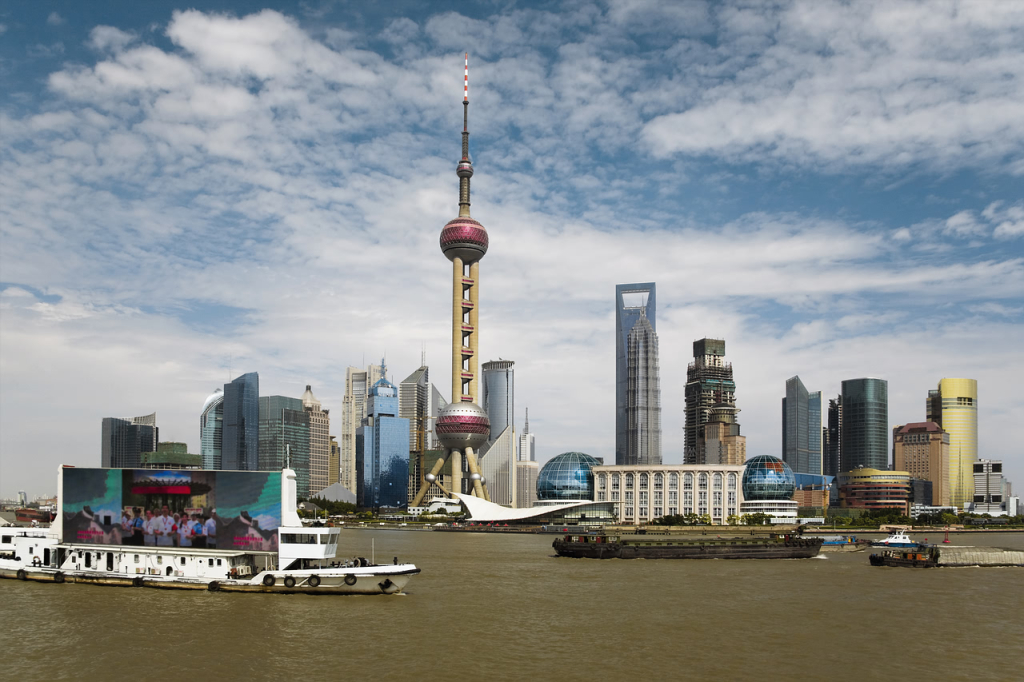

With a population of over 25 million, Shanghai, often referred to as the ‘Paris of the east’, is the economic centre of China.

With a population of over 25 million, Shanghai, often referred to as the ‘Paris of the east’, is the economic centre of China.

Situated in the Yangtze River Delta (YRD) in east China,[1] the city aims to be a global financial, trade, shipping and economic centre by 2020. In this article, Rainy Yao from Dezan Shira & Associates takes a closer look at this modern metropolis with its well-developed infrastructure and improving investment environment.

Economic overview

Shanghai accounts for one-eighth of China’s total financial income while taking up only 0.06 per cent of the nation’s land. In 2013, the city’s gross domestic product (GDP) exceeded RMB 2.16 trillion, the highest in all of China. Of this total, the city’s primary industry contributed RMB 12.9 billion and its secondary industry RMB 802.7 billion (up 6.1 per cent from 2012). The most notable contribution was from the service sector – a monumental RMB 1.34 trillion, or 62.2 per cent of total GDP. In the first half of 2014, the city’s GDP stood at RMB 1.09 trillion with a stable, annual growth rate of 7.1 per cent.[2]

The finance sector has also played a key role in Shanghai’s economic development, with an added-value in 2013 of RMB 282.3 billion (up 13.7 per cent from 2012). By the end of 2013, 215 foreign-invested financial institutions and 198 representative offices had been established in the city.

From January to September 2014, Shanghai has witnessed a sharp increase in foreign direct investment (FDI). Over 400 foreign-invested projects were introduced in September alone – a year-on-year growth rate of 34.1 per cent.[3]

Development zones

There are seven national-level development zones in Shanghai:

Caohejing Hi-tech Park

In 1991, Caohejing New Technology Park was upgraded by the State Council to Caohejing Hi-tech Park (CHJ). Aimed at becoming China’s answer to Silicon Valley, the park is designated for high-tech enterprises. Major industries include microelectronics, photoelectrons, software and new materials.[4]

Lujiazui Finance and Trade Zone

Approved in 1990, Lujiazui Finance and Trade Zone is the first of its kind in China. Designed to bolster the finance, insurance and trade sectors, the Lujiazui region is home to several major multinational corporations (MNCs) such as Siemens and Alcatel.[5]

Zhangjiang Hi-tech Park

Zhangjiang Hi-tech Park is a national-level industrial development zone established in 1992. After years of accelerated growth, Zhangjiang gradually established its own innovative industrial clusters, focusing on areas such as integrated circuits, bio-tech & pharmaceuticals, software and innovation. By the end of 2010, the park was home to more than 6,000 enterprises and total revenue stood at some RMB 102.1 billion.[6]

Investment opportunities

In order to attract foreign investment and multinational headquarters, Shanghai provides various preferential policies such as tax incentives and rent subsidies. Enterprises are highly encouraged to invest in the ‘cultural and creative’ industry, high-end equipment manufacturing and environmental protection. Shanghai has been chosen as the site of the BRICS (Brazil, Russia, India, China and South Africa) New Development Bank (NDB), providing even more opportunity for investment in the finance industry.

Preferential policies for multinational headquarters

Preferential policies for multinational headquarters

In July 2014, the Shanghai Government launched a so-called ‘Quasi-HQ Policy’, aimed at relaxing the requirements for MNCs to establish regional headquarters (HQs). Under the new policy, eligible wholly foreign-owned enterprises (WFOEs) and their branches can still enjoy the preferential policies offered to MNC headquarters, even if they don’t qualify as such, as long as they meet certain criteria including headcount, total assets and office space.

Newly-registered investment holding companies and management companies identified as regional HQs can receive start-up and rental subsidies. Additionally, regional HQs that have made a prominent contribution to local economic development will receive bonuses. The city also offers financial support to encourage MNCs to upgrade their existing regional HQs to pan-Asia, pan-Asia-Pacific or global HQs. Other incentives on offer include easier customs clearance, simplified entry/exit formalities and simplified employment permit formalities.[7]

China (Shanghai) Pilot Free Trade Zone (CSPFTZ)

The China (Shanghai) Pilot Free Trade Zone (CSPFTZ), officially approved in 2013, is a testing ground for market reforms and the smoother facilitation of foreign investment into China. It consists of the Waigaoqiao Free-Trade Zone, Waigaoqiao Bonded Logistics Park, Yangshan Bonded Port Area and Pudong Airport Comprehensive Bonded Zone. The zone adopts a Negative List approach to FDI restrictions, under which foreign investors enjoy equal treatment as Chinese domestic enterprises in any industry not explicitly restricted or prohibited in the list.

To unburden investors from China’s tedious administrative approval procedures, the CSPFTZ has established a unique ‘one-stop application processing platform’ for corporate establishment. This means applicants can obtain all necessary documents for company establishment in one place, significantly reducing the time taken to establish a company in the zone.

By 15th September, 2014, 1,677 foreign-invested enterprises (FIEs) had been established in the CSPFTZ, accounting for 13.7 per cent of the total number of enterprises in the zone. By comparison, at the end of 2013, only 228 FIEs had been set up in the zone, with a total registered capital of USD 980 million.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com.

[1] http://baike.baidu.com/view/1735.htm?fr=aladdin

[2] http://www.stats-sh.gov.cn/sjfb/201402/267416.html

[3] http://www.investment.gov.cn/shlywjqk/20141022/55314.html

[4] http://www.shanghai.gov.cn/shanghai/node2314/node2318/node9364/node23120/node23121/index.html

[5] http://www.sidp.gov.cn/2009/0627/4187.html

[6] http://en.zhangjiang.net/Default.aspx?tabid=476#aboutus1

[7] http://www.china-briefing.com/news/2014/07/23/shanghai-raises-stakes-attract-multinational-headquarters.html

Recent Comments