European SMEs are traditionally strong in the development of new technologies and providing related services. Although China is a challenging market to enter in terms of regulation of technology and intellectual property rights (IPR) enforcement, it still holds a great deal of promise for companies bringing innovative solutions and technology. In this article the EU SME Centre looks at the software business in China, explaining common ways of operating such businesses and the regulation that should be heeded.

European SMEs are traditionally strong in the development of new technologies and providing related services. Although China is a challenging market to enter in terms of regulation of technology and intellectual property rights (IPR) enforcement, it still holds a great deal of promise for companies bringing innovative solutions and technology. In this article the EU SME Centre looks at the software business in China, explaining common ways of operating such businesses and the regulation that should be heeded.

Software is a special product, the development of which does not usually require any special conditions such as natural resources or manufacturing facilities. It could therefore theoretically be developed either in China or abroad before being brought to the Chinese market. However, it should be noted that in China, software is subject to various regulations and more vulnerable to infringement of intellectual property.

Therefore it is of utmost importance to carefully consider your desired goals when drafting your business plan, as well as the risks associated with selling software to China. Your entry mode should then be based on this analysis.

Direct Investment into China

Example: A medium-sized company active in the software industry in the EU (Company A) is interested in establishing a subsidiary in China and employing local staff.

Manufacturing and development of software products falls under the ‘encouraged’ category in the latest version of the Catalogue for the Guidance of Foreign Investment issued in 2015. There are no substantial regulatory barriers preventing Company A from establishing a subsidiary engaged in manufacturing and development of software in China and the Chinese subsidiary in this industry may enjoy preferential treatment, e.g. less approval procedures and tax concessions.

Nevertheless, Company A will still have to conform to the other Chinese legislation governing the software business (e.g. the Administrative Measures for Software Products). Moreover, although the manufacturing and development of software products is generally encouraged by the Chinese Government, the distribution of certain software products is restricted or even prohibited under Chinese law (e.g. online games).

Sale of software products to China

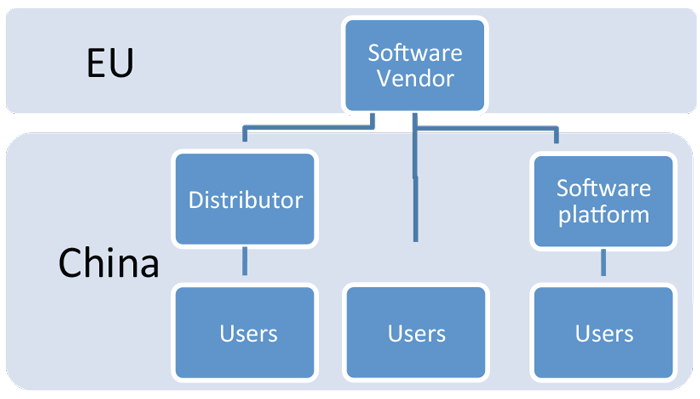

Example: A small-sized software vendor based in the EU (Company B) identifies opportunities in the rapidly growing Chinese market, but finds setting up a local subsidiary in China too costly.

Foreign companies may distribute their software products to Chinese users via various channels without direct investment into China. Below is an overview of the common distribution channels:

Websites located abroad

The advantage of this option is that software products and their transactions will not be regulated by the Chinese Government, as the transaction occurs outside Chinese territory. The disadvantage is that the Chinese Government can easily block access to a certain foreign website using the Great Chinese Firewall.

It is advisable to create Chinese language web pages, and enable purchasers to use Chinese credit cards or Alipay (a popular online payment platform in China, similar to PayPal).

Cooperation with Chinese software platforms

A foreign company may submit their software products to the Chinese market by entering into an Online Platform Service Agreement with a Chinese online software platform. The developer would be directly responsible for the content of the software. Before the software can be published on the platform, though, the online platform will review the software, to check whether it contains any illegal or improper information. For example, Tencent will review whether the software contains information such as pornography, gambling or defamatory content. It will also review the function of the software to be published, e.g., whether it will ‘steal’ customer information, or whether it contains improper advertisements.

Transactions occurring online in China are governed by relevant Chinese laws and regulations.[1] Software products are supervised by both online platforms and the relevant Chinese government authorities.

Online platforms may have the discretion to impose certain admittance standards for the software products. For instance, Baidu’s software platform will require the submitter to provide proof that he/she is the copyright owner of the software being submitted. It should be noted that the agreement between the platform and the software owner are, in most cases, prepared by the platform. Software owners have limited bargaining power on the designing of these service agreements.

Distribution via Chinese agents

It is common practice that software products are mostly traded by means of licensing. Trading of software products in China also follows this trend. The copyright owner of a software product makes profit by authorising others to use the software according to commercial conditions agreed by both parties. The following are some examples of licensing types:

- End users are licensed to use a copy of software products.

- A publisher/distributor is licensed to copy, distribute and publish software products.

- A software and/or hardware producer is licensed to pre-install a software product inside software/hardware.

A distribution licence agreement has to be arranged between foreign software vendors and local Chinese distributors, authorising the distributor to sell and distribute software products within a defined territory via certain distribution channels.

Tax considerations

If the end user is going to download the software directly from the website of Company B, there will be no customs clearance involved and thus no duties nor 17 per cent import VAT will be levied. However, payment of royalties[2] to a foreign resident will be subject to withholding tax[3] and six per cent VAT.[4]

If you would like to learn more on how to sell software to China or have any questions on this subject, contact the EU SME Centre.

The EU SME Centre in Beijing provides a comprehensive range of hands-on support services to European small and medium-sized enterprises (SMEs), getting them ready to do business in China.

Our team of experts provides advice and support in four areas – business development, law, standards and conformity and human resources. Collaborating with external experts worldwide, the Centre converts valuable knowledge and experience into practical business tools and services easily accessible online. From first-line advice to in-depth technical solutions, we offer services through Knowledge Centre, Advice Centre, Training Centre, SME Advocacy Platform and Hot-Desks.To learn more about the Centre, visit website www.eusmecentre.org.cn

The Centre is funded by the European Union and implemented by a consortium of six partners – the China-Britain Business Council, the Benelux Chamber of Commerce, the China-Italy Chamber of Commerce, the French Chamber of Commerce in China, the EUROCHAMBRES, and the European Union Chamber of Commerce in China.

[1] The Decision of the Standing Committee of the National People’s Congress on Internet Security Protection; the Decision of the Standing Committee of the National People’s Congress on Strengthening Network Information Protection; and the Administrative Measures for Internet Information Services.

[2] There is a clear definition of ‘royalties’ under Chinese tax law, and the difference between the ‘software usage fees’ and ‘royalties’ has been widely discussed. The central tax administration has provided certain clarification: regarding the granting of use rights to software (not including any license of IPR), if such granting is subject to a set of restrictive terms (scope of use, means and term), the usage fees will be deemed as ‘royalties’ for tax purposes.

[3] The specific rate depends on the Double Tax Treaty between China and the country where Company B resides.

[4] China’s VAT system uses multiple VAT rates rather than a single VAT rate for all goods and services: commonly used rates are 3%, 6%, 11%, 13% and 17%.

Recent Comments