Exciting opportunities in e-groceries

Online grocery shopping is quickly becoming one of the fastest rising global trends and has created new opportunities for China, along with the rest of the world. Currently in its 11th iteration, the Tetra Pack Index annually provides information on the latest developments in the food and beverage (F&B) industry. In this article, Tetra Pak utilises a case study on China’s dairy and beverage industry to illustrate the new and innovative changes that are coming with the adoption of smart packaging.

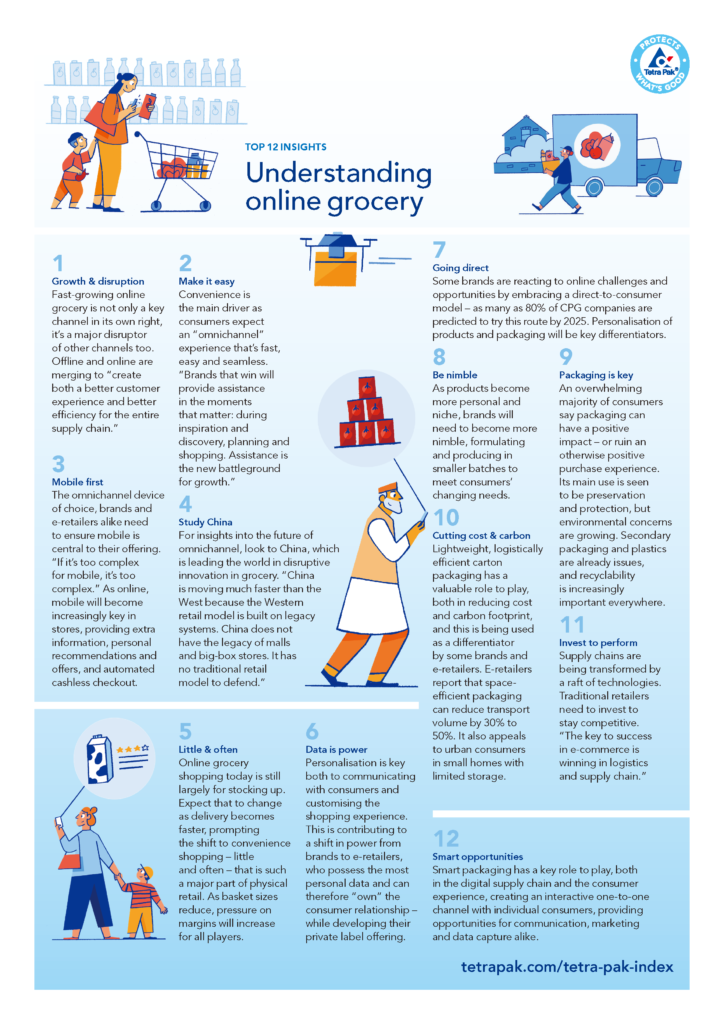

With the quick adoption of online grocery shopping. This year’s Tetra Pak Index focuses on how brands can leverage the rise of ‘e-groceries’ to become more efficient, have stronger consumer relationships and, ultimately, grow their business.

In this new omnichannel world of grocery shopping, packaging will play an important role in response to the growth of online grocery shopping. Smart packaging technologies utilise unique digital codes that will take both online and off-line grocery shopping in exciting new directions over the next few years.

Four trends shaping the growth of e-groceries

The 2018 index highlights the following four key trends helping to shape e-groceries:

Convenience

The main driver for on-line consumers using this new technology, is the constant need for products and services that can make a person’s life easier and more efficient. This new trend in technology can help to accomplish this goal by providing opportunities for easy product replacement and convenient packaging.

Sustainability

Putting pressure on the harms that come from using plastics, recognising the benefits that come from widespread recycling and awareness of the circular economy should continue to grow along with the use of online F&B platforms. Consumers want to know whether their favourite brands are ‘doing the right thing’ in their production and retail processes and by putting their information up online businesses are becoming much more transparent.

Personalisation and uniqueness

The customisation and personalisation of products will increasingly become important differentiators for consumers going forward. This is accelerating the shift towards direct-to-consumer sales with as much as 80 per cent of companies that produce consumer-packaged goods predicted to migrate to this model by 2025.

Technology and performance

‘Super-fast delivery’ in as little as 10 minutes is expected to have become widespread by 2025, pushing consumers to alter their behaviour to purchase goods more frequently and in smaller amounts, making the logistics side of a business much more complex. Supply chains will continue to be transformed by a raft of technologies, notably radio-frequency identification (RFID) and robotics, improving both the efficiency and transparency of the entire process.

12 Insights out of the Tetra Pak Index

The role of smart packaging

Smart packaging technologies that use different digital codes allow each and every product to be given a unique identifier. These codes can either be read by using a data scanning device or an ordinary smartphone, thus providing a vast amount of product information and opening up all kinds of possibilities.

E-retailers are calling for unique product identifiers that are compatible with automated technology used in the warehouse and distribution part of their business. Increased amounts of data and full traceability can help companies simplify business logistics and improve distribution efficiency to ensure real-time order fulfilment.

Alexandre Carvalho, director of global marketing services at Tetra Pak, believes that,

The rise of on-line grocery is a great opportunity for food and beverage brands, and packaging plays a key role in supporting their success. In particular, smart packaging helps drive greater transparency and efficiency in the supply chain, up and down stream, while also enabling a direct, interactive relationship with the consumer.

Case study: Adopt A Cow

Premium ambient white milk and yoghurt are growing areas for dairy in China, a market where concerns about food safety mean consumers particularly appreciate products that are fully traceable. As its name suggests, Adopt A Cow’s innovative approach is to allow consumers to ‘adopt’ a cow for a year, so they know exactly where their milk is coming from. In return, they receive 60 cartons of ambient white milk per year. Adopters can scan a unique QR code to view ‘their’ cow via webcam, 24-hours a day, and even stay at the farm their cow is at for two nights a year. Seasonal and monthly plans are also available.

The company was financed via Kickstarter and all subscriptions and purchases were originally exclusively managed online, but now, distribution has been extended to offline stores. This product’s price point is lower than premium ambient white milk, since the company claims its marketing approach saves on advertising costs, allowing them to provide both value for money and a high-quality product.

Conclusion

This type of technology creates an interactive experience with the consumer, which allows companies to have direct conversations with their customers to provide details on the product’s source materials and nutritional facts. In addition, this new online platform can be used by companies to provide games, promotional material and environmental information as well. At the same time, with the use of digital codes providing valuable insights businesses can continuously improve the shopping experience and make it more personalised for the consumer.

Tetra Pak is the world’s leading food processing and packaging solutions company. Working closely with customers and suppliers, they provide safe, innovative and environmentally sound products that each day meet the needs of hundreds of millions of people in more than 160 countries. With more than 24,000 employees around the world, they believe in responsible industry leadership and a sustainable approach to business. Their motto, “PROTECTS WHAT’S GOOD™”, reflects the company’s vision to make food safe and available, everywhere. The Tetra Pak Index 2018 is based on consumer research conducted in the United States (US), United Kingdom, China, Saudi Arabia and Korea, a global market segmentation study, as well as interviews with e-retailers in the US, Europe and China.

Recent Comments