Overview of China’s R&D environment for European SMEs

There is no doubt that China’s innovation ecosystem has grown exponentially. The country ranks 11th among 132 economies featured in the Global Innovation Index 2022.[1] Its research and development (R&D) spending exceeded Chinese yuan (CNY) 3 trillion for the first time in 2022, reaching 2.55 per cent of its gross domestic product (GDP) – higher than the average R&D spending in the EU. China hosts one-fifth of the world’s top 100 innovative clusters (same as the United States), among which Shenzhen-Hong Kong-Guangzhou, Beijing, and Shanghai-Suzhou rank second, third and sixth in the world, respectively.[2] In this article, Alessio Petino of the EU SME Centre provides some insights into the recognition and support available for small and medium-sized enterprises (SMES)—particularly European ones—in China’s R&D environment.

Although the focus has mainly been on nurturing national champions and state-owned research structures, China has—particularly since the 13th Five-year Plan (13FYP) (2016–2020)—gradually increased the importance given to the role that small and medium-sized enterprises (SMEs) play in advancingits innovation strategy and quest for self-reliance. In practice, this has translated into a wide array of schemes:

- Preferential tax policies, such as super pre-tax deductions of R&D expenses and super-amortisation of intellectual property (IP) assets (currently at 100 per cent and 200 per cent, respectively) for those officially recognised as technology-based SMEs (科技型中小企业).

- Various subsidies, incentives, innovation vouchers (科技创新券), and guidance funds (引导基金), at both national and local levels, especially aimed at technology SMEs, “specialised and sophisticated” SMEs (“专精特新”中小企业), and fast-growing ‘little giants’ (‘小巨人’企业).

- Innovative schemes to increase access to credit, such as IP pledge financing and subsidies on loan interests or insurance.

- Increasing the proportion of SMEs awarded government procurement contracts, including for first sets of products (首台套产品).

This support is being intensified during the 14FYP (2021–2025). The Ministry of Science and Technology’s (MOST’s) Notice on Creating a Better Environment to Support R&D of Technology-based SMEs, released in early 2022,[3] outlines a series of moves such as allocating a specific budget for SMEs in National Key R&D Programmes, supporting mobility and ‘revolving doors’ for scientists to work in both academia/research and SMEs, increasing the participation of SMEs in smart city application and demonstration projects, and including SMEs’ R&D activities as a key evaluation indicator for the administrations in sci-tech parks and high-technology zones. Achievements in preferential tax policies and easier access to credit were also reiterated in the 2023 Government Work Report.[4]

Challenges for foreign SMEs

However, it appears that foreign SMEs are in a disadvantaged position compared to domestic SMEs, and even foreign multinational corporations (MNCs). Foreign SMEs are rarely explicitly mentioned in official Chinese Government documents – in contrast to MNCs, regional headquarters or foreign R&D centres, which often have dedicated paragraphs or targeted opinions.[5] In fact, foreign SMEs normally do not receive the same degree of priority that MNCs do, and are largely absent from various dialogues that several local administrations in China have with the foreign business community, or in standardisation activities.

Furthermore, as regularly reported in the European Chamber’s and EU SME Centre’s Inter-Chamber SME Working Group Position Paper, foreign SMEs face bigger challenges in daily operationscompared to local SMEs and MNCs, such as higher requirements and limitations for obtaining corporate loans, and more difficulties in attracting and retaining skilled talent. In short, foreign SMEs may be considered less profitable, not contributing enough to short-term key performance indicators, and/or their brand not ‘prestigious’enough – even though in many cases SMEs possess state-of-the-art technologies.

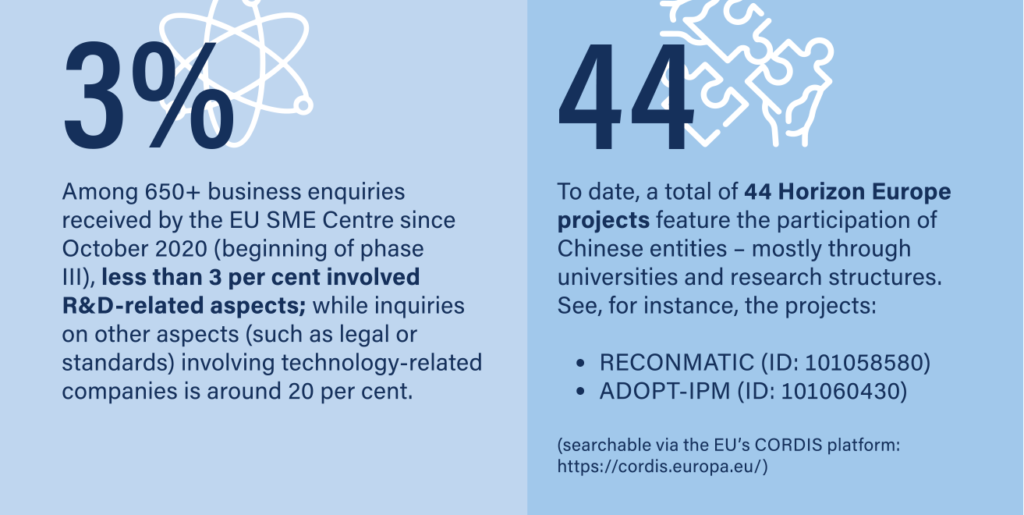

The result is that thenumber of EU SMEs with active R&D operations in China is low. First, resources are obviously more limited for SMEs, while expanding R&D operations in other countries is costly and often not perceived to be as essential as production and sales activities. Second, China is objectively a much more challenging environment compared to others in terms of IP protection and enforcement, cross-border movement of engineers, materials and data, fierce local competition, as well as red tape and overall compliance requirements. Keeping R&D activities at home or in close proximity, while selling in the Chinese market via traditional channels such as importers, distributors, representative offices or sales teams in the country, is just less risky and more profitable in the short-term. Even among those SMEs with active R&D in China, the majority are dedicated to further development of existing products and technologies (incremental innovation), adaptation to meet local market or regulatory needs, or product customisation. That is, R&D with not much ‘R’ but more ‘D’.

Opportunities for foreign SMEs

Still, there are many examples of EU SMEs successfully conducting R&D in China or in cooperation with Chinese actors.[6] These can be found across different sectors, but especially in areas with strong digital and consumer-orientated applications; i.e., areas where Chinese innovation and speed often anticipate and exceed that of other countries. This means that it is no longer inconceivable to see R&D achievements or ideas generated in China feeding into global R&D projects and products sold in other countries. Among other benefits, there is China’s large pool of science, technology, engineering and mathematics (STEM) graduates, though recruitment challenges and high turnover rates affect foreign SMEs more severely than domestic SMEs or MNCs; and a pro-innovation attitude among local administrations that translates into large administrative and financial support for R&D activities, which at least in the short/medium-term lowers the costs of innovation.

Each case is unique, but a common trait that EU SMEs active in R&D in China have is to think and act with a local mindset. For instance, a different IP strategy based on more active (yet not necessarily higher-value) patent-filing to unlock subsidies and incentives. The smaller dimension and limited resources of SMEs should not impede them from engaging and developing relations with big players, including state-owned or government organisations. EU SMEs should fully dedicate local resources to government/publicrelations. These will pay off in the long term – be it for obtaining a higher amount of subsidies, extending clients’ networks, hiring skilled talent or growing the company’s brand. At the same time, the importance of partnerships with academia should not be neglected.

The shifting of responsibilities for high-technology industries, high-technology zones and sci-tech parks from the MOST to the Ministry of Industry and Information Technology (MIIT) during the 2023 Two Sessions might also lead to more opportunities, as subsidies and incentives issued by local-level IIT departments (工业和信息化委、厅、局) are traditionally more easily and widely accessible for foreign companies compared to those of local-level departments of science and technology (科技委、厅、局). Relations with these bodies should be cultivated.

R&D as a market entry approach

R&D can also represent an interesting way to enter the Chinese market – albeit a ‘more advanced’ one. In this context, the EU-China Co-funding Mechanismrepresents a good platform: EU SMEs may include Chinese partners to join Horizon Europe projects in two flagship areas—Climate Change and Biodiversity; and Food, Agriculture and Biotechnologies—obtain EU funding[7] and, eventually, scale up that partnership at the end of the project to enter the Chinese market. Similar funding schemes also exist at the local level, especially—but not only—in Shanghai and Guangdong, through which a Chinese entity partnering up with foreign actors for a R&D project will get funding from the local administration. These are generally open to foreign companies from any country, though some are exclusively designed for certain countries – such as Finland, one of the EU’s pioneers in promoting joint innovation projects in China involving SMEs.

In conclusion, doing R&D in/with China is not easy for EU SMEs; it requires deeper knowledge of and engagement with the country and certainly comes with a great deal of risk– especially in terms of intellectual property protection, as well as constraints on outbound data and technology movement, i.e. factors which in the long term may have significant implications. But withcareful planning, meticulous execution and strong dedication, R&D in China may also present interesting benefits to EU SMEs.

Alessio Petino is the business advisor of the EU SME Centre (www.eusmecentre.org.cn), providing technical assistance to EU SMEs entering the Chinese market. He is also a consultant for various EU-funded projects in the area of research and innovation policy, funding, cooperation and challenges.

For any questions on R&D related issues in China, EU SMEs and business organisations may contact the EU SME Centre’s team for free-of-charge, confidential and one-to-one consultations: https://www.eusmecentre.org.cn/ask-the-expert/ or Info@eusmecentre.org.cn

[1] China, Global Innovation Index 2022, World Intellectual Property Organization (WIPO), 2022, viewed 20th March 2023, <https://www.wipo.int/edocs/pubdocs/en/wipo_pub_2000_2022/cn.pdf>

[2] Cluster ranking: The GII reveals the world’s top 100 science and technology (S&T) clusters and identifies the most S&T-intensive top global clusters, WIPO, 2022, viewed 20th March 2023, <https://www.wipo.int/export/sites/www/pressroom/en/documents/2022gii_clusters_chapter.pdf>

[3] Notice on Creating a Better Environment to Support R&D of Technology-based SMEs, MOST, 11th January 2022, viewed 20th March 2023, <http://www.gov.cn/zhengce/zhengceku/2022-01/13/content_5668067.htm>

[4] In particular, concerning access to credit, the Report highlighted that the “average interest rate of newly issued corporate loans was reduced to the lowest level since statistics are available”, and that “gradual cuts were made to interest rates on inclusive loans to micro and small businesses”. Unfortunately, this does not always apply to foreign SMEs in the country: Full text: Report on the Work of the Government, State Council, updated 15th March 2023, viewed 20th March 2023, <http://english.www.gov.cn/news/topnews/202303/15/content_WS64110ba2c6d0f528699db479.html>

[5] See, for instance, the Several Measures to Encourage Foreign Investment to Establish R&D Centres, released in January 2023 by the MOST and the Ministry of Commerce (MOFCOM). The official recognition as ‘foreign R&D centre’ requires certain thresholds which are not easily met by foreign SMEs in China, such as minimum R&D investment (US dollar (USD) 2 million in Shanghai, or CNY 8 million in Shenzhen), minimum 80 R&D personnel employed and CNY 20 million-worth of R&D equipment purchased (Shenzhen): Several Measures to Encourage Foreign Investment to Establish R&D Centres, MOST and MOFCOM, 1st January 2023, viewed 20th March 2023, <http://www.gov.cn/zhengce/content/2023-01/18/content_5737692.htm>

[6] An example of a very successful SME is Siveco China, a case study can be found on the EU SME Centre’s website: https://www.eusmecentre.org.cn/publications/siveco-china-lessons-from-20-years-in-the-chinese-maintenance-market/.

[7] At the same time, under certain conditions the Chinese partner may receive co-funding from the MOST, within the framework of the ‘Intergovernmental Science, Technology and Industry Cooperation’ National Key R&D Programme, with calls published twice a year.

Recent Comments