Understanding China’s R&D tax incentives

Research and development (R&D) tax incentive regimes have been implemented in many developed economies to boost growth in industries considered of high potential. Such regimes have also been in place in China for more than a decade. In this article, Liang Wu of KPMG outlines the Chinese incentives available to qualifying foreign enterprises, and how to address complexities in the application process.

As China’s urbanisation evolves, the government is increasingly acknowledging the importance of R&D in supporting business innovation, industry transformation and knowledge creation. Indeed, encouraging R&D and innovation activities has become a national strategy and one of the key central government priorities.

R&D covers enterprises applying science and technology knowledge for the purpose of obtaining new know-how or achieving substantive improvements in technologies, products or services, and processes. R&D incentive regimes have been widely adopted in most developed economies: more than 50 countries and jurisdictions currently have some form of an R&D incentive, with some jurisdictions offering multiple options.

Although opinions vary with respect to the effectiveness of R&D incentives, most studies have found that they increase private investment and innovation, influence where companies conduct R&D and ultimately benefit the health of the businesses involved.

Over the past few years, the global economy has been severely affected by the COVID-19 pandemic. Apart from the impact on healthcare systems and the social fabric, the pandemic has also changed the dynamics of cross-border supply chains and globalisation.

While some reports have suggested that a number of foreign enterprises as a result have considered or may be considering relocating their operations from China or reducing local investments in China, many major foreign enterprises are maintaining their faith in the prospects of the China market and are increasing their investments to drive growth amid challenging global economic conditions. Hence, it is in the interest of those companies to explore opportunities to take advantage of local R&D tax incentives.

Prevailing R&D tax incentives

The Chinese Government has promoted a broad range of R&D- or technology-related tax incentives to support enterprises to conduct R&D activities.

Current prevailing tax incentives include the following:

- Companies that qualified as high-and new-technology enterprises (HNTEs) are eligible for a reduced corporate income tax (CIT) rate of 15 per cent.

- Companies that qualify as technology advanced service enterprises (TASEs) are eligible for a reduced CIT rate of 15 per cent. Relevant service types include outbound and/or inbound information technology/business process/knowledge process outsourcing.

- Eligible companies in non-restricted industry sectors can enjoy super deductions for CIT purposes:

- Restricted industry sectors include tobacco manufacturing, accommodation and catering, wholesale and retail, real estate, leasing and commercial services, and entertainment.

- Manufacturing companies are entitled to CIT super deductions of 200 per cent.

- Non-manufacturing companies are entitled for CIT super deductions of 175 per cent for the first three quarters and 200 per cent for the fourth quarter of the year.

- HNTEs’/TASEs’ CIT benefits and super deductions can be used in parallel under certain conditions.

- Eligible software enterprises can be exempted from CIT for two consecutive years and can enjoy a 50 per cent reduced CIT rate for the first three years after they start to show profits. Key software enterprises can be exempted from CIT for five consecutive years and enjoy a reduced CIT rate of 10 per cent afterward.

- Eligible integrated circuit (IC) design companies can be exempted from CIT for two consecutive years and subject to a halved CIT rate for the three years after they start to show profits. For key IC design companies, an exemption from CIT of five consecutive years is available, after which they will be subject to a reduced CIT rate of 10 per cent.

- Eligible IC manufacturers could be eligible for full or half CIT exemptions for up to 10 years, depending on the types of IC products they produce.

- The portion of annual income derived from eligible technology transfers of a resident enterprise of China, which does not exceed Chinese yuan (CNY) 5 million (United States dollars (USD) 718,000), can be exempted from CIT; the portion that exceeds CNY 5 million can enjoy a 50 per cent reduction in CIT.

All these tax incentives apply to both domestic and foreign enterprises that qualify under the same set of criteria. It is also worth noting that the number of foreign enterprises in Mainland China that have successfully enjoyed R&D tax incentives has grown incrementally in recent years. Taking 2021 for example, the total tax saving of foreign enterprises through R&D super deduction for the first three quarters was reported as approximately CNY 66 billion.[1]

Scope of eligible R&D expenditures

The range of typical R&D expenditures that are eligible for tax incentives is wide and can include:

- R&D and technical staff costs;

- direct costs such as that of materials, power, utilities and so on;

- fixed asset depreciation for R&D activities;

- amortisation of intangible assets for R&D activities;

- designing and trial, prototyping and testing costs; and

- other expenses directly related to R&D activities.

Taking a collaborative approach for application preparation

In practice, companies may not be setting up the relevant R&D financial accounts required to completely capture these related expenditures. It is also challenging for companies to allocate the relevant expenses to each of the R&D activities or projects directly in their established finance systems. Therefore, auxiliary ledgers need to be separately and properly prepared to collect and allocate R&D expenditure on a project basis.

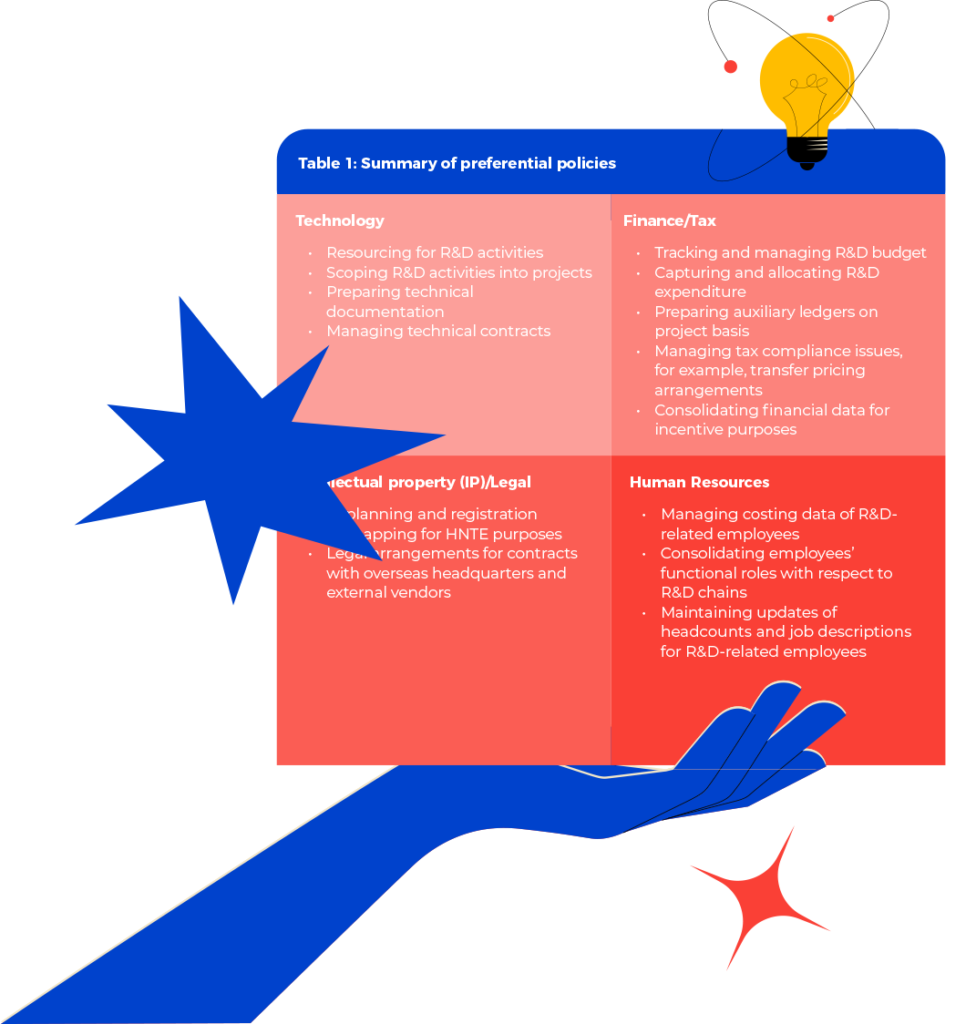

Success in applying for R&D incentives is often the result of a joint effort by multiple teams, not just the in-house tax team. The complex requirements can only be effectively managed collaboratively across each of the key functions shown in Table 1.

The uptake

In summary, the Chinese Government has promoted and continues to promote a broad range of R&D or technology-related tax incentives to support enterprises to conduct R&D activities that fall within a particular range. R&D tax incentives are a legal and effective tax benefit for foreign enterprises in China to improve corporate profitability, strengthen their financial health and generate funding for more sustainable technology upgrades.

To maximise the potential benefits from these policies, experience shows that foreign enterprises registered locally should take a compliant and systematic approach to secure the tax benefits and generate sustainable value.

KPMG China, part of the Global R&D Incentives practice network, has a nationwide team of professionals. Our robust methodology and extensive experience can help companies navigate the changing R&D landscape and maximise an organisation’s return on investment, drawing on diverse industry knowledge and technical backgrounds, including science, information technology, engineering, law, taxation and accounting.

Liang Wu is

a partner of KPMG China’s R&D Incentives Practice.

[1] Interview, State Council, 5th November 2021, viewed 9th March 2023, http://www.gov.cn/xinwen/2021zccfh/50/index.htm

Recent Comments