European Chamber messaging on behalf of its members

China’s Innovation Ecosystem: The Localisation Dilemma

Integrators – companies that are heavily involved in China’s innovation ecosystem

Integrators do extensive R&D in China for both the domestic and global markets. They form close partnerships with a range of actors in China (local firms, foreign firms, universities/research laboratories) and collaborate on a variety of issues, including human resources (HR) cultivation, core innovation and complementary innovation. They believe that an open approach to innovation is their best strategy, both in China and globally, because they can ‘run faster’ than the competition and claim market share to suppress their competitors’ growth potential. Examples: materials, chemicals, industrial inputs and machinery.

Market-chasers – companies that recognise China as the key global market for certain technologies, and that this is where ‘real innovation’ is taking place

This group of companies believes that they must be R&D players in China, not only to win local market share but also to stay globally competitive. It includes original equipment manufacturers (OEMs) of a given technology (for example, magnetic resonance imaging (MRI) machines), or for companies that are suppliers for that technology (like a supplier of magnets that go into MRI machines). This group may also engage in a wide range of collaborative partnerships, but core research conducted jointly tends to be limited to the technologies for which China is the main market, while core research of other technologies takes place in home markets. Examples: pharmaceuticals and their suppliers, battery and electric vehicle (EV) producers and their suppliers, suppliers of wind turbine manufacturers and suppliers of photovoltaic cells (PVC) manufacturers.

Decoupling: Severed Ties and Patchwork Globalisation

Market-driven supply chain shifts

European companies largely remain ‘in China, for China’; they have spent the last decade building up their supply chains inside the market and aim to continue this strategy. This keeps costs and administrative challenges low, while also taking advantage of China’s world-class industrial clusters and high-quality talent. Many of the MNCs interviewed for this report noted that their supplies for the Chinese market are up to 80 to 90 per cent onshored already. This allowed them to fare relatively well when the COVID-19 pandemic emerged.

For the European companies that produce and supply automobiles, clothing and accessories, food, electronics and technology, pharmaceuticals and medical devices—to name but a few—for the Chinese market, supply chains are their arteries. As noted in the extract from the Decoupling report, many of the companies in China for China already have a large portion of their supply chains—and production, from research and development through to marketisation—onshored in China.

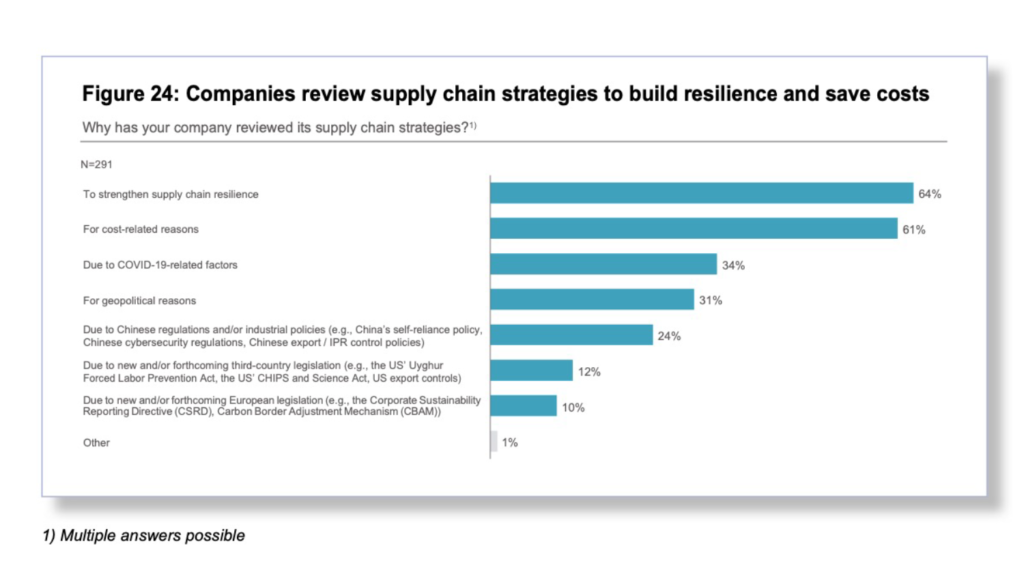

However, the unpredictability of conditions in China in recent years, due to COVID but also geopolitical tensions and the increasing politicalisation of business, has caused many European Chamber members to reassess their supply chain strategies. This was reflected in the Business Confidence Survey 2023, with three quarters of respondents reporting that they had reviewed their supply chains over the previous two years, largely for defensive reasons.

Business Confidence Survey 2023

Respondents are predominantly reviewing their supply chains to mitigate current and potential risks: strengthening supply chain resilience is the top reason (64%); countering COVID-19-related factors (34%) ranks third; geopolitical reasons (31%) fourth; Chinese regulations and/or industrial policies (24%) fifth; new and/or forthcoming third-country legislation (12%) sixth; and new and/or forthcoming EU legislation (10%) seventh. However, with cost-related reasons ranking second (61%), a key reason for EU companies to adjust their supply chain strategies is to maintain profitability, as labour and production in China become increasingly expensive.

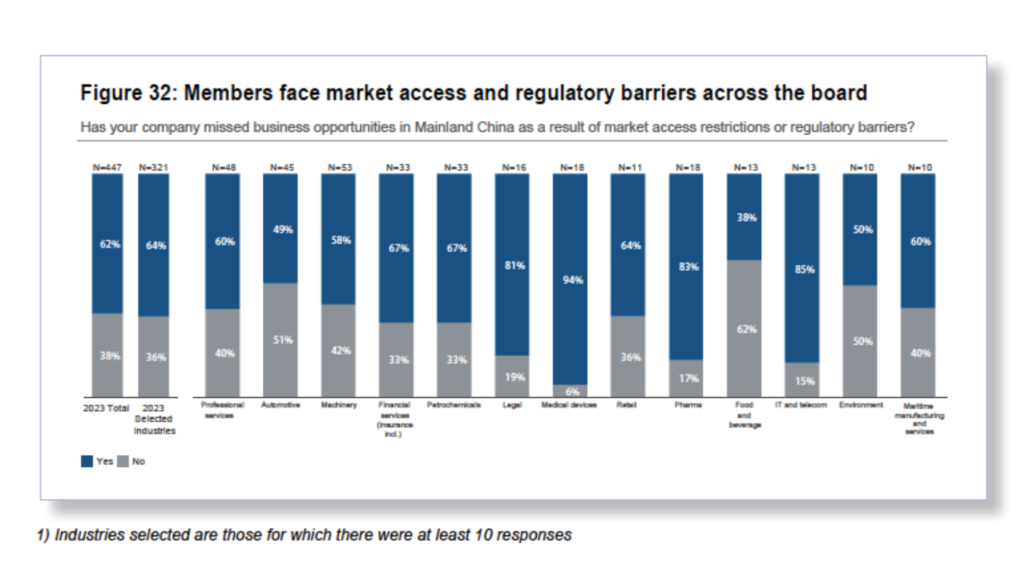

The challenges of doing business in China are of course not exclusive to companies that trade in goods; they also affect European Chamber members in the tertiary sector – for example, those who provide the professional, legal, consulting, financial, technology and HR services that keep the cogs in the manufacturing sector turning smoothly. The ability of these companies to develop their full potential has also been hampered by the long-standing market access and regulatory barriers.

Business Confidence Survey 2023

Lost business due to market access and regulatory barriers highest on record

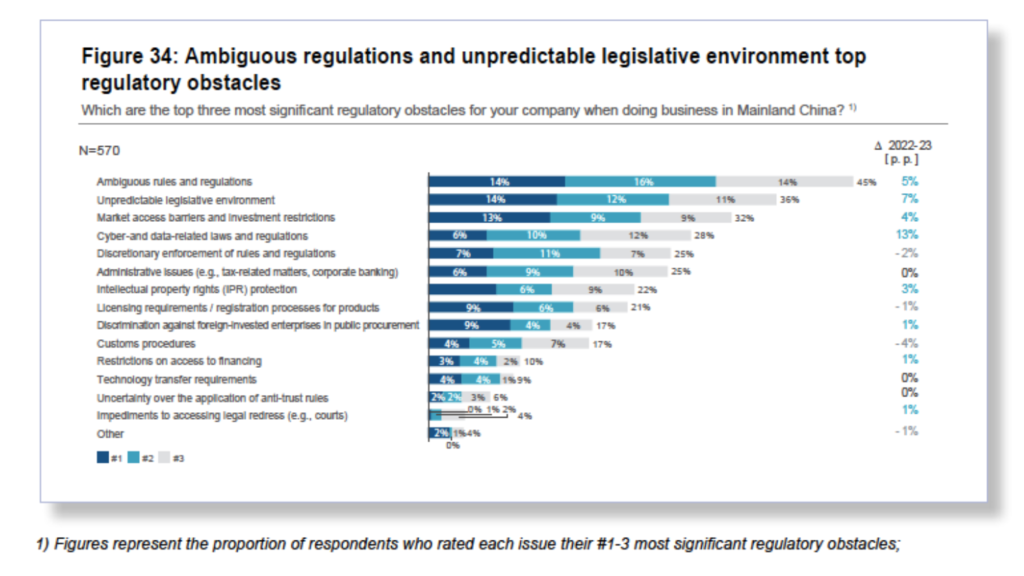

A record number of respondents (62%, +20pp) report having missed business opportunities because of market access and/or regulatory barriers in 2022. Stringent pandemic control measures posed the most significant obstacle, as frequent and unpredictable lockdowns and quarantine requirements often resulted in business operations grinding to a halt. Other key contributing factors included the persistence of long-standing administrative and regulatory barriers (see Figure 34), and the Chinese Government’s push for technological self-reliance in strategic areas.

A significant majority of respondents in IT and telecommunications (85%, +47pp y-o-y) reported this to be the case. The introduction of a series of stringent laws, measures, standards and guidelines on the protection of personal information and important data in recent years is a contributing factor, as is the imposition of excessive, non-transparent and at times arbitrary, supply chain controls.

The main purpose of the Business Confidence Survey and the thematic reports the Chamber releases, and indeed the main purpose of the European Chamber itself, is to highlight the concerns of our member companies and the difficulties they face while operating in the Chinese market, and to advocate potential solutions.

Most European companies that have entered or are considering entering the Chinese market have already proven themselves and their product/service offerings in the European Union (EU). In other words, they are the cream of the crop, and their presence in the Chinese market will be to the benefit of Chinese consumers and companies, by providing high quality goods and services, and increasing competition. Many Chamber members have indicated, despite the challenges of doing business in China, they remain eager to invest further – if given the chance.

In September 2023, the European Chamber will release its European Business in China Position Paper 2023/2024. This important white paper outlines the difficulties facing member companies in the goods, services and financial services sectors, as well as the challenges they face with cross-cutting topics such as compliance, environmental protection, intellectual property rights, and finance and taxation. It provides hundreds of targeted, actionable recommendations from industry experts representing European companies that have invested considerable time and resources to be ‘in China, for China’, and that wish to contribute more to the Chinese economy. Stay tuned to our social media and newsletters for details on the launch and the highlights of the publication’s messaging.

Recent Comments