The European Chamber’s Handy Guide

At the end of June 2019, China’s two negative lists governing foreign investment were revised and shortened. The Foreign Investment Negative List (FINL) and the Free Trade Zone Negative List for Foreign Investment (FTZL) each saw changes to several items that were previously restricted or prohibited. The now shorter lists have opened up the door to investment by foreign enterprises in many areas, but market access is more complicated than just these two lists. Secondary barriers—like access to licences and administrative approvals, as well as a whole variety of regulatory matters – also restrict meaningful access to the China market. In addition to these, the less-discussed Market Access Negative List (MANL) also serves as a direct barrier to market entry for companies – local ones as well as foreign.

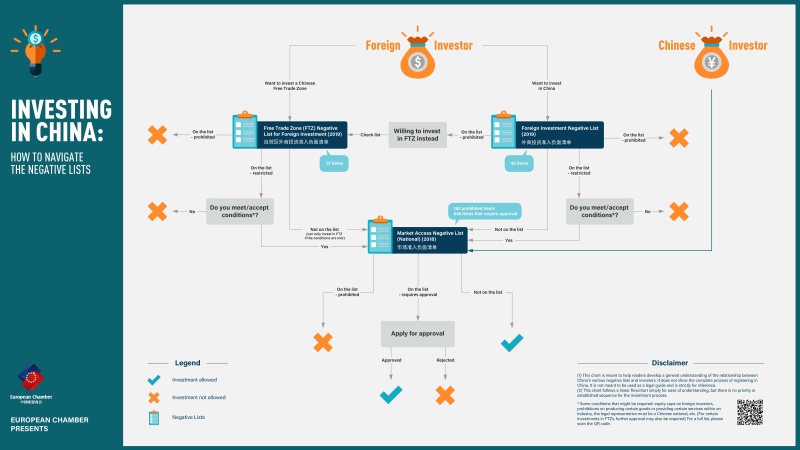

To help our members better understand the relationship between these three lists and what they mean for foreign and local companies, the European Chamber assembled the chart on the opposite page, as well as a couple of case studies to walk readers through the different barriers that exist.

Case Study One – a foreign law firm

A European law firm is considering investing in China. They look at the FINL and find that Item 25 prohibits foreign investment in Chinese legal affairs, though the list notes that foreign investors are allowed to provide services informing customers about the impact of China’s legal environment (as consultants rather than lawyers). They would prefer to invest as a proper law firm and decide to check if that is an option in the FTZL. Unfortunately, they encounter the same prohibition.

If they are only willing to invest as a proper law firm, then this company would find itself completely blocked out of the market. However, they do have the option to invest on the condition that they do so only as consultants with limited services. If they meet/accept those conditions, they can move on to the MANL to check for further barriers. Depending on the type of consulting they plan to provide, they may or may not have to first apply for approval before being allowed to invest.

Case Study Two – a foreign electric vehicle manufacturer

A European automotive company wants to establish a 100 per cent foreign-owned electric vehicle plant in Hebei Province, just outside of Beijing. They check the FINL and find that while there are equity caps for foreign ownership in most automotive manufacturing, the caps have been lifted for new-energy vehicles (NEVs), which include electric vehicles. They check the FTZL and find that they have no restrictions on either list, so they choose to look into investing in Hebei instead of in an FTZ.

They next check the MANL and find that new investments in the automotive sector require approval, according to Item 138. Specifically, any investments made in pure electric vehicles require approval from the Investment Department of the State Council. If they can obtain this approval, they will be cleared for investment, thought they will then need to pass a wide variety of administrative hurdles, such as construction permits and licensing for type-approval, to establish the plant and begin production.

To download the guide to the negative lists, please click here:

Recent Comments