On 30th May, 2013, the European Chamber of Commerce in China released its annual Business Confidence Survey. The purpose of the survey is to take an annual snapshot of European companies’ successes and challenges in China. Published since 2004, it has enabled the Chamber to build a rich data set to serve as a broad indicator for how European companies judge the business environment in China, both now and in the future.

On 30th May, 2013, the European Chamber of Commerce in China released its annual Business Confidence Survey. The purpose of the survey is to take an annual snapshot of European companies’ successes and challenges in China. Published since 2004, it has enabled the Chamber to build a rich data set to serve as a broad indicator for how European companies judge the business environment in China, both now and in the future.

The Chamber invited its members to take part in the Business Confidence Survey 2013 (BCS 2013) over a two-week period during March 2013. The survey was conducted in cooperation with Roland Berger Strategy Consultants.

There were 1,403 eligible entities. With 526 respondents completing the survey, the BCS 2013 achieved a response rate of 37 per cent. Of those respondents, 61 per cent participated in last year’s survey. This number has increased each year, suggesting an increasing stability in the data set. It has also enabled year-on-year comparisons, coupled with new insights identified by first-time participants.

The survey comprised 47 questions, grouped under four key themes:

- Company Profile and Statistics;

- Outlook on China, Competition, Company Strategy and Regulation;

- Human Resources;

- Financial Performance.

Executive Summary

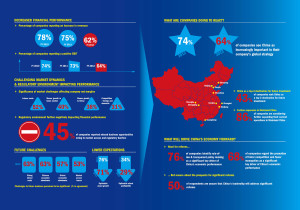

Tougher business conditions, both globally and in China, have led to a diminished financial performance for European companies in China in recent years. In 2012:

- Increased revenues were reported by only 62% of companies, versus 75% and 78% in preceding years;

- Profitability was only reported by 64% of companies, compared with 73% and 74% in preceding years.

Many market dynamics are contributing to this. Key factors having strong impacts on net profit margins include:

- Slower economic growth in European and Chinese markets named by 40% and 38% respectively;

- Labour costs cited by 52% of companies;

- Competition from privately-owned Chinese companies mentioned by 30% of companies.

The relatively poor financial results are further exacerbated by the regulatory environment.

Missed business opportunities owing to market access and regulatory barriers were reported by 45 per cent of all European companies. These challenging market dynamics, coupled with a difficult regulatory environment, show that significant economic reforms are needed more than ever before to ensure continued strong growth, mitigate cost increases, unlock market opportunities and create an overall well-functioning and efficient business environment.

But as uncertainty still prevails, with 53 per cent deeming that market access issues will also continue to be a significant challenge, optimism is waning:

- Optimism about future revenue growth has shrunk to a four-year low of just 71% of EU companies.

- The outlook for optimism regarding profitability for the next two years has reached an all-time low of only 29% of companies.

Despite many of the lowest business confidence results since the onset of the global economic downturn, it is clear that China is still being perceived as the best of a challenging global situation. China continues to be a priority in global strategies and a mainstay for global revenue generation. European companies are resigning themselves to this reality and remain committed to the Chinese market:

China is seen as increasingly important in global strategies by 64% of companies, albeit a decline from 74% in 2012.

China is rated as a top-three country for future investments by 43% of companies.

Further expansions to current China operations are considered by 86% of European companies.

Going forward, respondents are overwhelmingly united in their view of the key drivers for China’s future economic performance:

- Rule of law and transparent policy-making was identified as a significant key driver by 76% of companies.

- The promotion of fairer competition and fewer monopolies was also regarded to be a potentially significant driver of China’s future economic performance by 68% of companies.

To download a full copy of the European Business in China Confidence Survey 2013, please click here.

Recent Comments