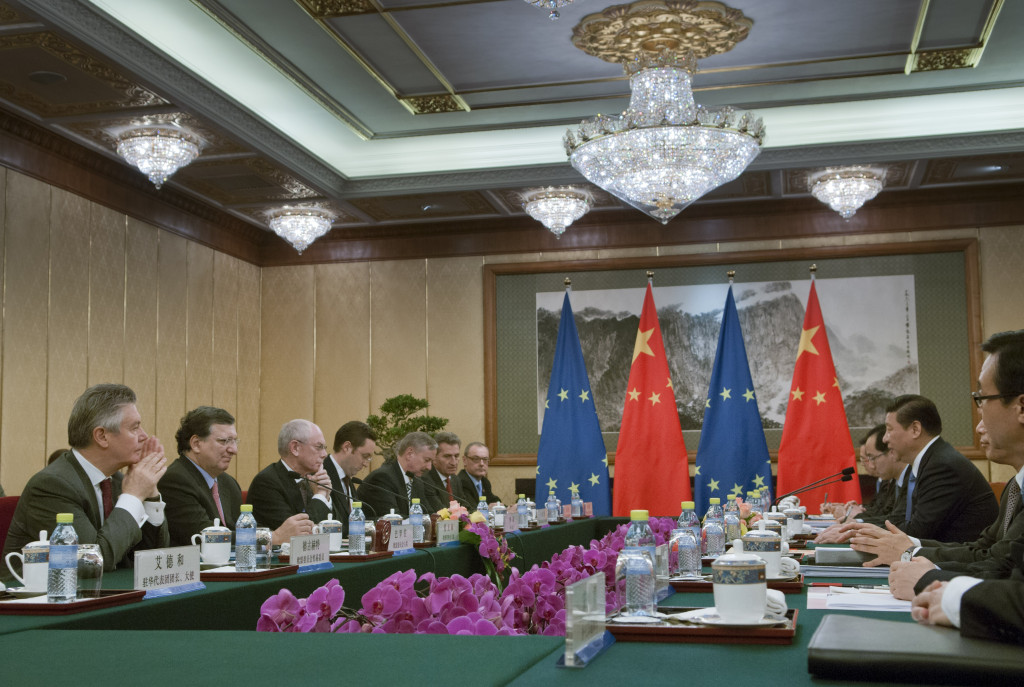

From an EU perspective there are a number of reasons to feel positive about current EU-China trade and investment relations, whether it is the commencement of negotiations for the bilateral investment agreement or the settling of recent trade disputes through dialogue. EURObiz’s Carl Hayward spoke to Xing Houyuan, Vice President of the Chinese Academy of International Trade and Economic Cooperation, Ministry of Commerce (MOFCOM), to garner a Chinese perspective.

What do you consider to be the most significant development in EU-China trade and investment in the past 12 months?

China is the EUs largest trade partner, while the EU is China’s second largest, and I believe that this status is very significant. In 2013 the bilateral trade between the two sides has been increasing. Imports from the EU into China has been growing at around 3.7 per cent, which is higher than exports from China to the EU, demonstrating that China’s policy of seeking a balanced trade relationship with the EU has taken effect, especially in the area of industry and equipment upgrades, an area which the EU has made significant contributions in both technology and investment.

China is in a period of economic transformation, where it needs more demand and consumption to boost its economy. We can see that Chinese tariffs are being lowered, particularly tariffs on luxury goods from the EU, so I hope that more consumer goods can enter the Chinese market and we can find more high-quality products from the EU here. As a consumer, as well as an academic, I will be very happy to see this.

But there were some issues too. Last year we witnessed the trade dispute over solar cells, and although we avoided a trade war and resolved the situation it was not the result that the industry was looking for. There was also a trade dispute in the footwear industry, which caused some dissatisfaction on both sides. So I hope that China and the EU can continue to cooperate at all levels and keep each other’s bilateral interests at heart, while resolving disputes and reducing trade frictions.

What significant changes to the EU-China investment climate do you anticipate in the near future?

We anticipate big changes following the EU-China bilateral investment agreement negotiations, and are hoping for a positive outcome. However, since the negotiations have just started it is too early to say what specific changes we would expect to see.

The investment agreement is very important, but is not the only significant change we anticipate. We have observed that interest in investing in Europe has increased amongst Chinese companies, particularly towards the end of last year following the recovery of the economy in Europe, along with certain countries becoming more open to Chinese investment, including investment from Chinese state-owned enterprises.

Similarly we see that EU investment into China is also growing as well, so in general this makes me very hopeful.

How do you think the laws for foreign-invested enterprises are likely to change?

There will certainly be changes to the Foreign Investment Catalogue. I believe that it will eventually be transformed into a Negative List, like the one being used in the China (Shanghai) Pilot Free Trade Zone (CSPFTZ), probably after 2015. The reason I say after 2015 is because when the National Congress laid out the framework for the CSPFTZ, it was stated that the model could be replicated in other places by this time.

Certain areas that were previously forbidden or restricted will be opened up in this year’s Foreign Investment Catalogue, such as healthcare, education and nursing homes for elderly people. In addition to opening up certain areas, I believe it will also make provisions for treating foreign-invested companies and domestic companies equally, and this is extremely important.

What do you see as the major challenges for Chinese companies looking to invest in Europe?

I studied this problem quite seriously. Chinese investors are very confused about the legal requirements for investment. If they are going to invest in Europe, are they going to pay more attention to EU trade and investment laws, or those of a specific country? There is not much transparency in this regard.

At the end of 2012, after the 18th National Congress, I accompanied a friendship delegation to the EU, and I asked this question of many of the EU officials, and I didn’t receive a clear answer.

Another issue relates to work permits and visas. Some countries have stringent visa policies which are not open to adjustment. If a Chinese company wants to invest in Europe, they will need to bring in management teams, and if certain countries are making it difficult to acquire visas, this presents a hurdle to investment that needs to be overcome. Chinese entrepreneurs hope that the EU can be more open in this respect to facilitate them moving their management teams overseas.

What are the most recent figures on FDI from Europe into China and vice-versa, and your expectations for future trends?

During 2013, Chinese investment to the EU amounted to around EUR 3.62 billion, and EU investment to China was EUR 6.52 billion. There are some discrepancies among other sources though. Some media report bilateral trade as being quite balanced.

China is still an attractive investment destination for EU companies for three reasons. First, China is the EU’s largest importer, and the market remains very lucrative. Second, the 28 countries in the EU are facing a major industry upgrade and China is a good place for them to move their industries, particular in the service sector. Third, China’s investment environment is much improved.

I agree that China’s investment climate is too restrictive to foreign companies in certain areas; some areas are not even open to investment from domestic companies. We should follow the path laid down following the Third Plenum which allows for a more open, market-based environment and open up more to foreign investment. Right now, the major investments from the EU—around 90 per cent―are in the form of greenfield investments. What we hope to see more of is cross-border mergers instead.

What do you think the Chamber could do to improve the investment climate/to improve EU-China Business relations?

We notice there has been a surge in Chinese investment in Britain and Germany, but the investment has been pretty unbalanced across other European countries. We would like to see more information provided on projects, industries and policies across all European countries in order for Chinese companies to get a clear and complete picture of the EU’s investment environment so they can clearly understand all opportunities that are available.

In terms of the EU investing in China it should be the same. China should welcome EU investment to help industry transformation, particularly in the areas such as low-carbon technologies, manufacturing and high tech goods. These are all areas where the EU has an advantage, so we hope that China could be depicted as a positive destination for investment.

Is the China (Shanghai) Pilot Free Trade Zone progressing the way you would expect?

I think so yes. It is actually progressing a lot better than we had anticipated, and when I visited Shanghai six times last year I noticed positive changes. I would like to see the expansion of the free trade zone to encompass the whole of Shanghai municipality. I believe it could be the launch pad for the next round of opening up and reform, just as has happened in Shenzhen and Xiamen.

Where would you expect the next pilot scheme to be launched?

Tianjin and Guangdong: right now these places could help engineer China’s next round of opening up, growth and development.

When is it anticipated that the Negative List will be reduced in the China (Shanghai) Pilot Free Trade Zone?

It will definitely be reduced, but I can’t really say when or by how much. It would be in the region of a 30 per cent reduction, as the list currently incorporates investment conditions in areas such as mining, agriculture and large-scale manufacturing, none of which take place in the Zone. This reduction will be coupled with the opening of some service areas.

The Chinese Academy of International Trade and Economic Cooperation (CAITEC) is an institution of applied economic and trade policy research and consultancy directly under the Ministry of Commerce (MOFCOM) of the People’s Republic of China. Its undertakings cover research, information gathering and analysis, consulting services, publishing services and property management.

Recent Comments