To many, China Manufacturing 2025 (CM2025) appears to be an initiative purely for boosting domestic industrial capacity and creating national champions who can eventually dominate the global stage. To an extent, this sentiment was compounded by the frequent references to “indigenous innovation” in China’s 13th Five-Year Plan. Some foreign-invested enterprises (FIEs) are wondering, quite rightly, ‘are we part of this?’ Kiran Patel, Marketing and Communications Director, LehmanBrown International Accountants, says that there is a place at the CM2025 table for FIEs, and identifies eight areas where they could find opportunities.

To many, China Manufacturing 2025 (CM2025) appears to be an initiative purely for boosting domestic industrial capacity and creating national champions who can eventually dominate the global stage. To an extent, this sentiment was compounded by the frequent references to “indigenous innovation” in China’s 13th Five-Year Plan. Some foreign-invested enterprises (FIEs) are wondering, quite rightly, ‘are we part of this?’ Kiran Patel, Marketing and Communications Director, LehmanBrown International Accountants, says that there is a place at the CM2025 table for FIEs, and identifies eight areas where they could find opportunities.

Influenced by Germany’s Industry 4.0, Premier Li commented at the official launch of the CM2025 initiative that it will “upgrade China from a manufacturer of quantity to a manufacturer of quality”. A roadmap has since been established to build a thriving, innovation-led economy through to 2025 and beyond.

China’s hand has been forced by a number of factors: cheaper manufacturing labour in South East Asia and other emerging economies; weakening demand for exports – particularly from the US and Europe; overcapacity; and—as shown in the Global Innovation Index Report 2015—an innovation gap between China and other, developed economies.

Consequently, industrial modernisation and reform now sits at the heart of the government’s strategic agenda with President Xi and Premier Li identifying an explicit need for China to transition towards manufacturing high-tech machinery, and to be at the forefront of global innovation if it is to remain competitive in the face of the next wave of economic challenges resulting from its rapid growth.

Does this mean that there are opportunities for FIEs to thrive in this new environment? After all, China Industry 4.0 could be construed by certain quarters as a scheme to close the door more firmly on FIEs.

Why reform industry?

China has become synonymous with the negative branding of ‘Made in China’ and copycat technologies. With the slowdown of the global manufacturing sector in Europe and the US, China must successfully reform and modernise by stepping into high-end manufacturing if it is to position itself to lead global manufacturing beyond 2025 and become a leading exporter of domestic technology. This is essential for China’s international expansion.

It is significant that China’s labour costs are rising along with a workforce that, for the first time in the past two decades, declined in 2014. Increasing competition from ASEAN countries and Central Asia, who have both intensified their focus on manufacturing to compete with China—as well as providing both a cheaper workforce and a more supportive regulatory environment for foreign businesses—is providing further impetus for China’s need to reform. In a move that would have been considered unthinkable five years ago, some companies have brought their manufacturing operations back to the US and Europe. While still the world leader in terms of output, China is still relatively weak in terms of innovation and core technologies. At the heart of CM2025’s strategic goals is the core objective to transform this.

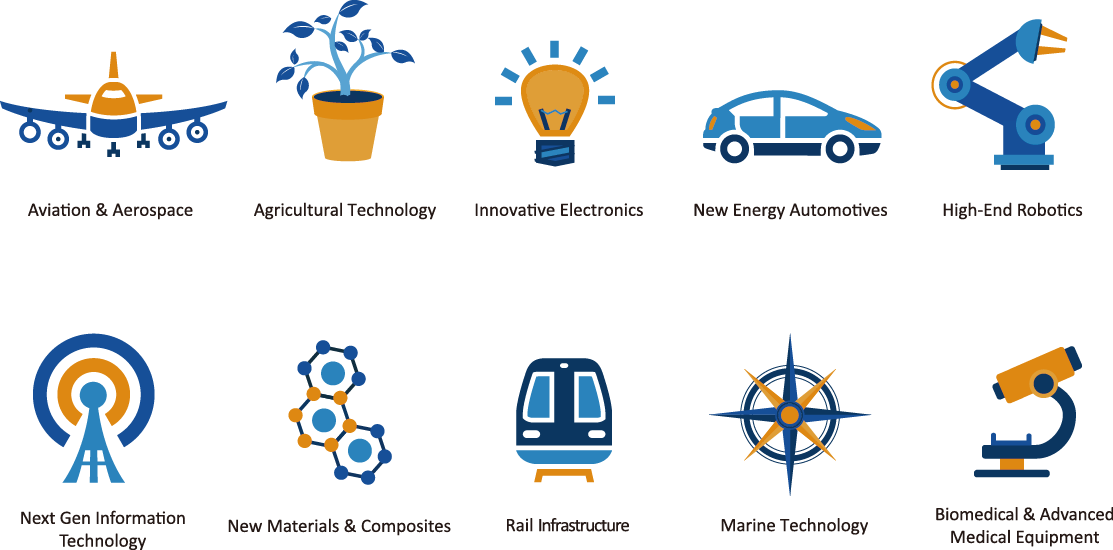

Made in China 2025: 10 key focuses

China will focus industrial upgrading in 10 key sectors, thus creating channels of growth for FIEs across a broad range of industries and territories.

What is Internet Plus?

Internet Plus is a fully integrated component of the CM2025 initiative that will serve to integrate ‘Internet’ with the delivery of industrial and economic upgrading. China is expected to exceed well over 700 million netizens by the end of 2016, and exhibits phenomenal potential for further growth and penetration – currently 52.2 per cent penetration compared to the UK’s 93 per cent. The possibilities for growth within the tech innovation space are vast, with e-commerce both domestically and abroad being the key driver alongside big data, cloud computing, Internet finance and the concept of an Internet of Things (IoT).

One unique possibility of Industry 4.0 is the growth potential of the ‘Industrial Internet’ through linking manufacturing with IoT technologies. In order to make this possible, the government will be launching fiscal and tax policies to help selected industries grow, creating a platform for both domestic and foreign-invested SMEs to evolve within the Internet Economy.

Challenges for FIEs

Industry 4.0 in China will present both a new set of obstacles and opportunities for FIEs operating in China’s high-end manufacturing space. Aligned with the government’s drive to promote Chinese brands at the centre of China’s innovation drive, foreign manufacturers will be confronted with increasing competition.

Factors of price, potential protectionism, a historically loose application of intellectual property (IP) laws, and incentives for and government subsidisation of local manufacturers are all areas that FIEs need to pay close attention to. Clearer standardisation, classification and further stimulation of the competitiveness of local Chinese manufacturers in core competency areas where FIEs have previously dominated will also become increasingly prevalent. Emulation of best practices and Western management techniques will be increasingly adopted in order to develop China’s core manufacturing competencies further.

Opportunities for FIEs

Although the general perception is that CM2025 is primarily geared towards stimulating the growth of Chinese high-end manufacturing, it will create opportunities for FIEs, not only in primary cities but also across second- and third-tier cities. Foreign enterprises are still competitive and will remain a key component for China to realise its vision of economic transformation, at least in the medium term.

The following are the opportunity areas where FIEs can engage with China’s evolving economy:

Export of High-End Manufacturing Equipment

Fuelled by China’s drive to modernise manufacturing practices and propel itself up the manufacturing value chain, the demand for high-end robotics, automation technologies and high-end equipment in general will create an export opportunity for FIEs. Europe possesses world class equipment, best practice experience in manufacturing innovation, quality of output, lean practice and environmental standards to export to China.

Standards, Testing, Compliance and Certifications

Coupled with the export of equipment and technologies to China, as Chinese companies move up the value chain, the importance of complying with international standards and achieving international certifications will only grow. This creates a continued opportunity for standards and benchmarking organisations to enable China to meet globally acceptable criteria.

Manufacturing Consultancy and Expertise

CM2025 will strive to limit China’s dependence on foreign technologies; however specific skills and consultancy to drive process improvement, project management, risk management and process engineering will be in high demand.

Environment and Green Tech

In order to improve the living standards of its citizens and deliver green growth, the Chinese Government is mandated to pursue a more environmentally-friendly economic model, thus providing an opportunity for FIEs to export first-class green technologies such as alternative energies, hybrid vehicles, waste management, and disposal and recycling technologies to address the issues caused by rapid, low-quality economic growth.

Financial and Professional Services Outbound Consultancy

Tied in with the Belt and Road Initiative (BRI) beyond the clear and explicit goals of Made in China 2025, China is seeking to export its technology across borders and develop its own brand competence internationally. Financial services, particularly banking, insurance and leasing will be more sought-after by Chinese companies if their projects include an overseas element. With strong potential for M&A as China grows outwards, the full spectrum of professional services including accounting, M&A advisory, audit and due diligence as well as legal services and marketing consultancy is an area of strength that FIEs can leverage.

Collaborative R&D

Appetite for product innovation will lead to opportunities for collaborative R&D projects between domestic Chinese enterprises and FIEs.

Education and Vocational Skills Training

CM2025 and China Industry 4.0 as a whole will require a significant development of talent and a highly-skilled workforce to deliver. Vocational education is another key area for FIEs to leverage experience and ensure that China’s industrial vision is realistically implementable from a human capital perspective.

Retail, E-commerce and Leveraging IOT

It has been predicted by McKinsey that China’s e-commerce market will reach GBP 3 trillion by 2020. This is larger than the US, UK, Japan, Germany and France combined and is not restricted to first-tier cities. According to a January 2016 survey by The Economist Corporate Network and Admaster, second-tier cities have overtaken first-tier cities in terms of purchases made on mobile devices. This creates a number of opportunities across the wider scope of established foreign consumer products within the field of retail, fashion and innovative product design. FIEs are therefore well positioned to leverage the new business models and distribution channels that the Internet Economy will provide.

In Summary

The business climate remains highly competitive for FIEs to thrive under China Industry 4.0’s economic and industrial upgrading initiatives. Across the 10 key sectors identified in CM2025 there are already a number of successful cases whereby involvement of FIEs has been integral to China’s success. This provides FIEs with a platform to continue operations in China. The creation of new opportunities through CM2025, and Internet Plus in particular, means that China should very much be on the agenda of FIEs for the foreseeable future, as long as the government carry out the necessary reforms to foster a thriving innovative and creative economy.

LehmanBrown International Accountants is a China-focused and licensed full service accounting, taxation and business advisory firm. Through offering ‘whole-of-life’ services, LehmanBrown offers its clients assistance throughout every step of the China business life cycle—from preconception to afterlife—and is committed to enabling the business operations of both foreign-invested and domestic enterprises to thrive in China.

Recent Comments