Despite the rapid catch-up process that is being fostered by the 12th Five-Year Plan and other influential policy documents, the technical innovation capacity of the Chinese information communications technology (ICT) industry is still weak. At the same time, a large number of mostly small- or medium-sized European companies are at the forefront of current research and development in this area.

Despite the rapid catch-up process that is being fostered by the 12th Five-Year Plan and other influential policy documents, the technical innovation capacity of the Chinese information communications technology (ICT) industry is still weak. At the same time, a large number of mostly small- or medium-sized European companies are at the forefront of current research and development in this area.

In a recent report by the EU SME Centre, the authors identify specific opportunities that present themselves because of this competitive edge and highlight ways in which small companies from Europe can capitalise on them. A look at the market structure shows, however, that only companies with expertise in highly sophisticated technologies will be able to enjoy sustainable success in this highly competitive environment.

The ICT market has been one of the main priorities of China’s economic policies for more than ten years. The government has been pouring money into large-scale research and development efforts, ICT clusters and business support services to achieve fundamental breakthroughs in core ICT technologies and turn the domestic industry from the global assembly line into a world-leading innovation hub. These investments have paid off, and after years of annual growth rates of around 17 per cent the industry is now worth EUR 1.3 billion, contributing six per cent to China’s GDP and providing 14.3 million people with employment.

Market Structure and Opportunities for EU SMEs

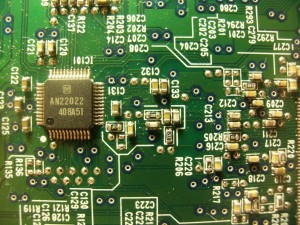

The ICT industry covers a wide range of products and services which can be divided into four more or less distinctive categories: telecommunications, hardware, software and services. The following table gives some examples of specific technologies and services for each of these categories:

| Telecommunications | Hardware | Software | Services |

|

|

|

|

Telecommunications is dominated by the three state-owned carriers—China Mobile, China Unicom and China Telecom—and communication equipment giants such as Huawei and ZTE. Their comprehensive competitive strength, combined with the restrictive regulatory environment, make it very difficult for small European market entrants to succeed in this segment.

However, the issuance of 4G licences to utilise the domestically developed 4G TD-LTE technology and the subsequent commercialisation of the networks will have profound effects on the entire industry. Although large companies will occupy a big market share, in particular for equipment procurement, SMEs will have opportunities to provide small equipment, components, software and other supporting systems.

With revenues estimated to have grown to EUR 172.5 billion in 2013, China’s hardware industry is the established production base of the world. At the same time, China is also the largest market for computer products. Development has been focused on mobile phone technology in recent years, which drives demand as well as innovation. Selected cutting edge computer (high-performance and grid computing), integrated circuit (system-on-a-chip design and micro electromechanical systems) and display technology (LED and projection technology) is being especially promoted by the Chinese Government.

The internet of things is one niche in which European SMEs will find opportunities in China’s IT hardware market as the Chinese Government is realising the huge potential benefits of increased efficiency in logistics and the smart metering of the energy and water supply. Thus, demand for network-embedded systems will increase, an opportunity for EU SMEs owning cutting-edge technologies in customised application microprocessors.

China’s software industry has likewise been growing at a fast pace. In 2012, total revenue reached EUR 291.6 billion, representing a year-on-year rise of 32.7 per cent. The general market is dominated by domestic developers—there were more than 28,000 software companies in 2012—while global software companies like Microsoft, Oracle or SAP are serving the high-end clientele.

With over a quarter of the Chinese population accessing the internet through mobile phones the demand for applications is huge. As willingness to pay for software is still low in China, many developers opt for in-app sales and advertisements to generate returns. The same applies for game developers, where the so-called ‘freemium’ model (software-as-service) has proven to be the most economically viable option.

Services

IT services, which include extremely popular consumer services such as mobile applications, e-commerce, online gaming and cloud computing, have developed on a par with the rapid spread of internet connectivity in China. With Chinese mobile applications like WeChat starting to go global and domestic e-commerce booming, recent developments in this market are proof that indigenous Chinese innovation is quickly becoming a reality. Online gaming and cloud computing are growing fast as well, with the gaming market expected to reach EUR 5.9 billion in 2014 and an estimated 200 million cloud users in 2013.

The service sector arguably affords the most opportunities to EU SMEs, especially in IT consultancy (development and integration of databases and IT systems, green ICT) and web development (website design for foreign companies in China, e-storefronts).

Challenges in the Market

In addition to challenges related to market fragmentation, fierce competition and HR issues, EU SMEs looking to enter China’s ICT market are also facing a restrictive legal and regulatory environment. For example, foreign companies are effectively blocked from entering a number of industries because only private Chinese companies (with very limited foreign involvement) are qualified to apply for a licence.

Intellectual property (IP) protection is still a big issue for most European SMEs as well. Over the years gaining market access in exchange for bringing foreign technology to China has been a successful bargain for many European companies. Unfortunately some Chinese companies seeking to acquire foreign technology still obtain it through inadvertent leakage of IP or the breach of agreements or Chinese law.

Regulations (and the lack thereof) also impede access to China’s public procurement market. There is very limited regulation of government procurement to refer to and projects that are of public interest and/or use public funds are often not included. In addition, because of policies to support indigenous innovation, products with IPR owned by Chinese companies are prioritised in some projects.

All things considered, the Chinese ICT market is a challenging arena for European SMEs. However, companies with a thorough knowledge of the market and a good network of local contacts will be able to benefit from China’s digital revolution, assuming they have the right product and people for the market and the persistence and expertise necessary to navigate the regulatory framework.

The EU SME Centre assists European SMEs by providing a comprehensive range of free, hands-on support services including the provision of information, confidential advice, networking events and training. The Centre also acts as a platform facilitating coordination amongst Member State and European public and private sector service providers to SMEs. The EU SME Centre is a project funded by the European Union. To find out more about the Centre and its services, visit www.eusmecentre.org.cn.

Recent Comments