China presents a challenging environment for foreign manufacturing companies. This is true across the board, from garments to electronics, but wholly foreign-owned enterprises (WFOEs) manufacturing medical devices face additional obstacles, especially if they also sell on the Chinese market. In the following article Renaud Anjoran, Operations Manager for China Manufacturing Consultants and vice chair of the Chamber’s Sourcing Forum in South China, lists some of the biggest challenges.

China presents a challenging environment for foreign manufacturing companies. This is true across the board, from garments to electronics, but wholly foreign-owned enterprises (WFOEs) manufacturing medical devices face additional obstacles, especially if they also sell on the Chinese market. In the following article Renaud Anjoran, Operations Manager for China Manufacturing Consultants and vice chair of the Chamber’s Sourcing Forum in South China, lists some of the biggest challenges.

Ensuring a high quality standard

A faulty medical device might lead to a deadly outcome; therefore quality is first and foremost. Medical devices need perfect quality and need to be manufactured to very strict specifications and standards.

By and large, foreign companies that have been manufacturing in China for a number of years have successfully set up the right quality systems, trained their staff and got their operations in order. However, purchasing quality components from local suppliers is an ongoing challenge. I see high incoming quality control reject rates (often above 30 per cent for some components) in most foreign-owned factories I visit. And the lower the order quantity, the higher the reject rate. Manufacturers need to keep a constant eye on what suppliers are shipping – for example, are the electronics explosion proof (since they will be used with oxygen), is the plastic medical grade?

The design and development of new products is also a source of many issues. Many engineers are falsely under the impression that they can simply copy designs without knowing and understanding the design intent. The result is that while the external appearance of a product may be identical, the function may be flawed. This can lead to dangerous and potentially deadly outcomes. For example, some chemotherapy drugs that are used for treating cancer patients have very aggressive chemical compounds that can cause plastic materials to become brittle and crack. In the West, this is a commonly known design feature and (more expensive) materials are selected because of their crack-resistant properties. In China, this risk is often overlooked and (cheaper) plastic materials that are inappropriate for the design are selected, leading to product failures where patients and caregivers are exposed to hazardous drugs. The solution to this is either to learn from mistakes, a costly and dangerous process, or to invest in the foreign talent capable of educating Chinese engineers and suppliers about these potential risks.

Certifications and client-specific requirements

Certifications and client-specific requirements

Medical certification for ISO13485 and other medical standards are usually mandatory, and in many cases factories need a clean room that needs to be certified. In addition, manufacturers have to comply with client-specific needs. For example, General Electric imposes some of its own standards. In short, players in the medical industry need to deal with many levels of approval.

One serious challenge is the special treatment Chinese manufacturers tend to receive from certifying bodies in China. It represents unfair competition for foreign companies and ensures there are always lower-cost competitors on the market. Which leads to the next challenge…

Competition from local players

Medical devices are, on average, sold at a premium and high quality is a must. However, all customers take cost into consideration, too, and competition from Chinese companies can be deadly. The problem is some local manufacturers take the liberty of copying products and production processes freely, while at the same time they can afford to sell these products at a lower price because they face more relaxed controls and enforcement.

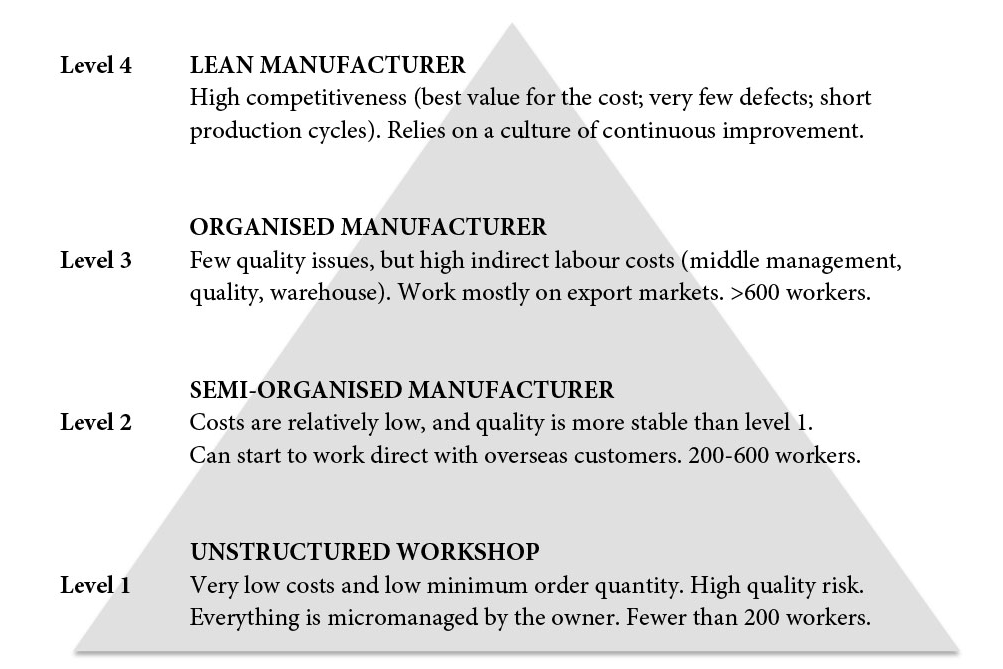

Fifteen years ago, local players used to compete with (very) low prices and suffered from poor quality. However, some of them have upped their game by hiring professional managers and putting systems in place – often under the guidance of large foreign customers. Many have made the leap from what we call ‘level 1’ to ‘level 3’ (see below).

The four levels of Chinese manufacturers

Compounding the challenge already presented by local competition, Chinese government agencies have repeatedly stated that China wants to develop top-class medical companies and that Chinese state-run hospitals should preferably source medical devices from local Chinese brands. This is clear discrimination against foreign-owned manufacturers.[1]

Compounding the challenge already presented by local competition, Chinese government agencies have repeatedly stated that China wants to develop top-class medical companies and that Chinese state-run hospitals should preferably source medical devices from local Chinese brands. This is clear discrimination against foreign-owned manufacturers.[1]

The solution for manufacturing WFOEs is to always be one level higher than the competition. One such strategy is to adopt lean manufacturing principles and tools – so far, only a tiny proportion of Chinese-owned factories have made the efforts required for a lean transformation, and most of the success stories are still in the automotive industry.

China-specific issues

In addition to these issues, selling in China presents its own challenges.

The first one is selling on the domestic market. Sitting between the manufacturer and the hospital is a distributor. The primary role of the distributor is to make sure everyone in the hospital system is ‘taken care of’. He needs to mark the price up significantly. The main issue that arises for foreign companies is the risk of violating anti-corruption policies followed in the West.

The second issue is insurance reimbursement. The reimbursement rate is sometimes higher for Chinese companies than it is for foreign companies, since some Chinese manufacturers have managed to get away with additional unfounded claims – however, the government is scrutinising product claims more and more closely and this situation is showing signs of improvement.

Another issue is China’s unique standards. For example, the standards for many in vitro diagnostics (IVD) products are not scientifically sound, some specifications are contradictory and some test methods laid down in these standards cannot actually be carried out.[2]

Looking forward

Beijing has launched a vast reform of the healthcare system. It is currently underway and it is hoped that this will result in better conditions for foreign manufacturers of medical devices, since China is moving closer to international regulatory practices.

Whether the new regulations will be truly implemented and fulfil their promise remains to be seen and this is an issue the Chamber will be paying close attention to over the coming months.

Renaud Anjoran and the rest of China Manufacturing Consultants’ team have been helping China-based manufacturers reduce their costs, improve their quality and get better organised through lean manufacturing techniques and supply-chain reorganisations. In 2005 and 2006, Renaud worked in a Hong Kong-based trading company, before moving to Mainland China in 2007. He received his MS in International Business from Bordeaux Business School and an MBA from Wake Forest University. Renaud may be contacted at renaud.anjoran@cmc-consultants.com.

[1] European Business in China Position Paper 2015-2016, European Union Chamber of Commerce in China, September 2015, p. 202, <http://www.europeanchamber.com.cn/en/publications-archive/364/Healthcare_Equipment_Position_Paper_2015_2016>

[2] Ibid, p.208

Recent Comments