The EU’s Sustainable Finance Disclosure Regulation: what it means for investment managers and advisors

The European Union’s (EU’s) Sustainable Finance Disclosure Regulation (SFDR) became effective on 10th March 2021. Alongside entities based in the EU, the SFDR will also affect all asset management and advisory firms globally—including those in Asia Pacific (APAC) and China—that either have undertakings for the collective investment in transferable securities (UCITS) products; provide advisory services to EU asset managers or asset owners; or market and sell fund products (including Cayman) or advisory services in the EU. These firms will be required to disclose their sustainability-related assessment and reporting practices, both on an entity and product level, covering principal adverse sustainability impacts, pre-contractual products and periodic statements, among others. Una Peiyun Qu of Seneca ESG brings us the details.

The European Commission first published its regulation on sustainability-related disclosures in the financial services sector in 2019. In parallel to the implementation of the SFDR in March this year, the European Supervisory Authorities (ESAs) also issued the draft Regulatory Technical Standards (RTS)as a supplement on 2nd February 2021. The RTS specify disclosure content, methodologies and presentation at both entity and product levels under the SFDR for investment firms and their products and services. They will come into force on 1st January 2022. The precautionary principle of sustainable investments under the SFDR is to ‘do no significant harm’. Therefore, the disclosure requirements consist of four parts: principal adverse impacts; pre-contractual information; periodic statements; and website reporting.

Disclosure requirements and timeline

The SFDR specifies the following scopes of financial market participants (FMPs), financial advisers and financial products as subject to the regulation:

Financial market participants

- an insurance undertaking that provides an insurance‐based investment product (IBIP)

- an investment firm that provides portfolio management

- an institution for occupational retirement provision

- a manufacturer of a pension product

- an alternative investment fund manager (AIFM)

- a pan‐European personal pension (PEPP) product provider

- a manager of a qualifying venture capital fund registered in accordance with Article 14 of Regulation (EU) No. 345/2013

- a UCITS management company

- a credit institution that provides portfolio management

Financial advisers

- an insurance intermediary/undertaking that advises on IBIPs

- a credit institution that provides investment advice

- an investment firm that provides investment advice

- an AIFM that provides investment advice in accordance with point (b)(i) of Article 6(4) of Directive 2011/61/EU

- a UCITS management company that provides investment advice in accordance with point (b)(i) of Article 6(3) of Directive 2009/65/EC

Financial products

- a portfolio managed in accordance with mandates given by clients on a discretionary client-by-client basis that include one or more financial instruments

- an alternative investment fund

- an IBIP

- a pension product/scheme

- a UCITS

- a PEPP

Entity-level

Although the SFDR divides financial entities into two types, FMPs and financial advisers, at the corporate level, it requires both to consider the principle adverse impacts (PAI) of investments, with an initial requirement of ‘comply or explain’.

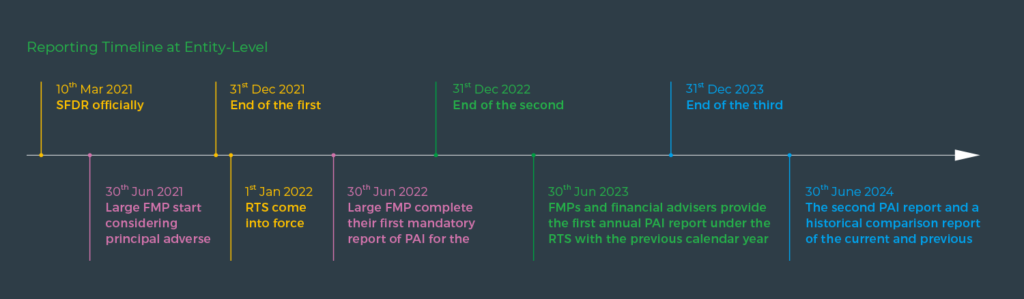

As for differences, notably, reporting PAI on sustainability factors of their investments is mandatory for large-sized FMPs (more than 500 employees). Large FMPs must update the principal adverse sustainability impacts statement on their websites by 30th June each year, taking the previous calendar year as the reference period. Their first statement is due on 30th June 2022, with a reference period from 10th March 2021 to 31st December 2021.

The RTS, effective from 1st January 2022, will bring further specified requirements and templates for disclosures. Under these standards, all FMPs and financial advisers will need to publish and maintain PAI statements on their websites. The disclosure frequency and schedule will be the same as that of large FMPs, which means the first reporting date for smaller FMPs and financial advisors based on the RTS will be by 30th June 2023.

The RTS provide a template for PAI disclosures, which includes 18 mandatory indicators and an additional 46 indicators for disclosure options. For financial advisors, fewer indicators are required, but they instead also have to disclose related sustainability information for the products and practices they advise on.

Even if FMPs and financial advisers do not consider PAI, they will still need to provide their ‘no consideration of sustainability adverse impacts’ statements online.

Product-level

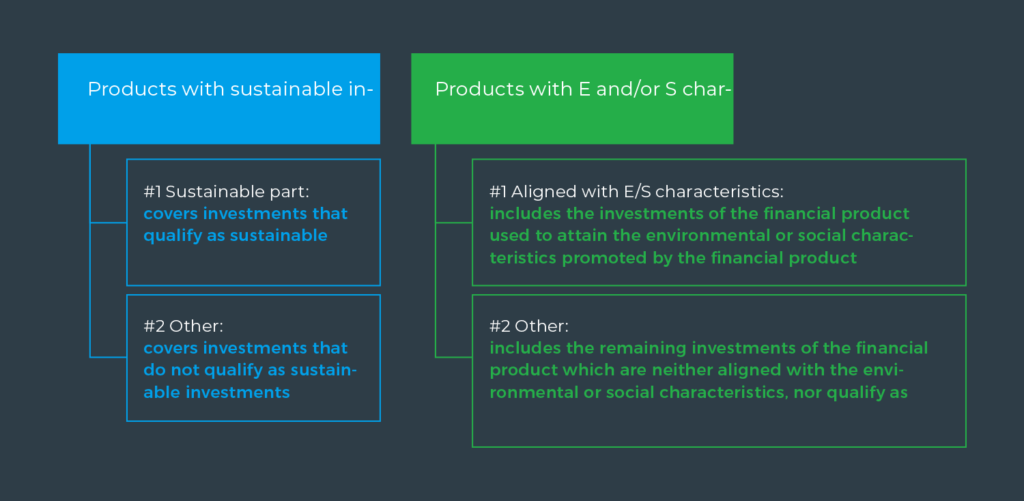

For financial products, the reporting requirements mainly include pre-contractual, periodic and website disclosures. Expanding on the basic disclosure requirements specified in the SFDR, the RTS provide four templates for pre-contractual and periodic disclosures at the product level. These come in the form of question lists, and are designed for financial products that promote environmental and/or social characteristics, or have sustainable investments as their objectives.

Moreover, FMPs should disclose the impacts of up to 15 of the top investments of their financial products in the periodic statements, covering those that account for the largest proportion of their investments during the reference period. They will also eventually need to publish a historical comparison of their reports for at least five previous reference periods.

For non-ESG related financial products, companies are required to specify that those products are not obliged to take the EU criteria for environmental sustainability into consideration.

In addition, FMPs also need to make other ‘sustainability-related disclosures’ on their websites, for example providing additional details on financial products, such as investment strategy.

Potential impacts

The SFDR is intended to improve the transparency of investment firms’ products and financial advisers’ services. Along with the Non-Financial Reporting Directive (NFRD) announced in 2014 and the taxonomy released in June 2020, this regulation highlights the EU’s efforts to promote the flow of capital into environmentally sustainable projects and investments, as well as to curb fictitious green projects or ‘greenwashing’. It may also signal a new trend in the global green development and investment sectors.

The EU is the one of the world’s largest economies. The implementation of the SFDR and the future RTS will not only impact EU entities; it will also affect companies and financial institutions outside of the EU in the following ways.

- Non-EU companies: those that have subsidiaries and businesses in the EU will also have to provide the principal adverse sustainability impact statements, pre-contractual and periodic reports, and additional information on their websites in accordance with the regulations.

- Non-EU investment firms: those that are now offering or plan to offer registered financial products in the EU will have to make product-level disclosures. Notably, even if a company considers its product as non-ESG-related, it should also explain why the sustainability risks are not relevant to the product.

- Non-EU financial advisers: those that arenow offering or plan to offer investment advisory services to EU firms are indirectly subject to the SFDR. Since the SFDR is mandatory for EU financial and non-financial entities, they may choose service providers—whether EU or non-EU—that can help them comply with the regulatory requirements and obligations. Based on this consideration, non-EU financial advisers should also follow the SFDR requirements when providing services to EU clients.

From a broader perspective, it is anticipated that the SDFR will lead to the development of similar policies in other regions and countries. For instance, Singapore and South Korea have considered building a local green investment taxonomy. This implies that even if a company thinks it will not have connections with the EU, it may still need to take the SFDR, the taxonomy and other sustainability disclosure policies into account when planning for the future.

Seneca ESG is a business intelligence company delivering solutions for corporate sustainability assessment, reporting and integration with financial services. In additional to data acquisition and environmental, social, and governance (ESG) integration services, the company’s flagship Zeno platform facilitates ESG data management, tailored analyses and sustainability-driven business workflows for both corporate and investment manager clients.

Recent Comments