What does this congressional meeting spell for the future of business in China

What does this congressional meeting spell for the future of business in China

The 19th National Congress of the Communist Party of China (19th Party Congress) will take place soon, and foreign businesses need to think about what effect this event may have on their operations in China. To get a clear picture of what the 19th Party Congress means for business dealings in China, Andrew Polk, the co-founder of Trivium/China, lays out some questions that corporations should be asking themselves leading up to this important party event.

19th Party Congress is just around the corner, and foreign businesses need to start thinking through the implications of this event for their operations in China. For the uninitiated, the 19th Party Congress is China’s quinquennial conclave that regularly reshuffles party leadership and sets the policy direction for the next five-year period. It is the most important political event in China.

Despite the clear consequences this event has for party personnel and overall governance in China, the specific import that a party congress holds for businesses can be difficult to decipher. To get a clear picture of what the 19th Party Congress means for multinational corporations (MNCs) in China today, executives need to know the right questions to ask and where to look for the answers.

In this article, we lay out a few of the key questions that businesses need to be mulling over in the up-coming weeks. We also discuss some of the likely answers to those question and key developments to watch for going forward.

What should businesses be looking for?

Part of the confusion surrounding the 19th Party Congress stems from the fact that most analysts focus on the wrong things. Most of the prognosticating, by far, centres around who may emerge, over the course of the event, as the new leadership of the Communist Party of China (CPC). People want to know who will be sitting on the Politburo Standing Committee alongside General Secretary Xi Jinping for the next five years.

While the composition of the CPC’s top echelon matters when it comes to the execution of specific government relations strategies, the direction of overall policy matters just as much, if not more. Getting an early read on various policy trajectories can help companies position themselves for success vis-à-vis the party, the government, business partners and competitors.

Rather than obsessing over the names of China’s elite leaders, businesses should be taking a deep dive into the Party Congress Report that General Secretary Xi Jinping will deliver at the congress. It is hard to overstate the importance of this report. It sets the direction of policy along myriad fronts for the next five years and, in theory, every policy decision from 2018–2022 should flow out of it.

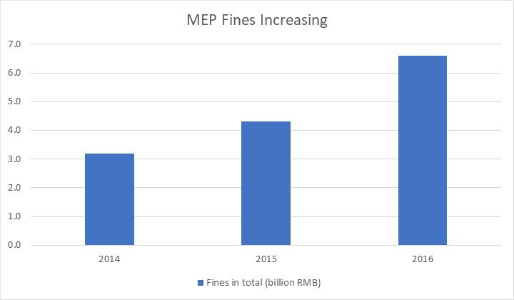

Because ‘party speak’ is often inscrutable, analysts and businesses do not pay enough attention to the report, but for those that do, important signals can be gleaned. At the 18th Party Congress, for example, ‘ecological civilisation’ (party speak for environmental protection) was given equal priority with economic development in the report; so, it is no coincidence that environmental protection has seen sustained policy attention over the past five years. For businesses, that is not an abstract development—it has hit companies’ pockets directly. Over the past three years, the Ministry of Environmental Protection (MEP) has handed out 14 billion yuan in fines for violating various environmental protection policies.

Figure 1. MEP’s China environment situation communique 中国环境状况公报

Figure 1. MEP’s China environment situation communique 中国环境状况公报

The report will not contain minute policy details, as it is a wide-ranging artefact. Rather, it will touch on a host of important issues ranging from cultural development and party discipline to economic development and foreign policy. Additionally, much of the speech will only outline the successes of the last five years. However, for those who know where to look, the report will signal the CPC’s intentions in some key policy areas.

What is the relationship between the party and the government?

Any executive that has spent time in China recently has seen the resurgence of the CPC first-hand. Some notable changes have included: rejuvenated party cells taking on more prominent roles inside MNCs, decision-making responsibilities shifting from governmental agencies toward party bodies and intransigent local party officials being scared stiff by the anti-corruption campaign. It is clear that the party now plays a much larger role in business than it did five years ago.

In hindsight, this development was signalled in the 18th Party Congress Report. That document included new language saying that the CPC should exert more control over state institutions. It is highly likely that such language will be strengthened in this year’s work report. Any emphasis on the CPC’s role in governance, combined with a coming revamp to the CPC’s supervision and discipline system set to take place early next year, will further institutionalise the shift towards a more assertive CPC presence when it comes to policy formulation and implementation. Companies should resist the temptation to fight against this trend and instead, learn how to productively react to it.

How is the growth target treated?

General Secretary Xi Jinping is unlikely to discuss the growth target explicitly, but the way he discusses economic growth and development, in general, will be extremely important. Inside the party, a robust debate is taking place over the growth target and whether or not it should be abandoned as a relic of the past. General Secretary Xi himself said at a Politburo meeting back in November 2016, that growth “is not a numbers game” and that qualitative development indicators should increasingly be emphasised.

Any reiteration that the quality of growth matters as much as hitting specific development targets would be a strong indicator that General Secretary Xi is laying the groundwork to back away from the previously stated growth target. We do not know if that will happen, but we will be watching closely. The continued pursuit of overly high growth implies a substantially different policy mix than the acceptance and facilitation of the economy’s shift towards slower, but more sustainable growth. The former would benefit companies aligned with infrastructure spending and property development, while the latter would imply more policy support for the services sector, including healthcare, education and professional services.

How is technological development and data treated?

Companies need to figure out China’s evolving stance on both technological advancement and data storage. That is a tall order given that no one inside the Chinese Government seems to be able to articulate the exact strategy for advancement. The report may not lay out a detailed plan for China’s technological development and data storage issues, but at the 19th Party Congress it is likely to see more granularity than many other policy areas, and any emphasis here by General Secretary Xi will be key.

Many companies in China are wondering, for example, how strongly the 2017 Cybersecurity Law of the People’s Republic of China will be implemented. The optimistic view is that China does not want to scare away businesses by enacting and enforcing overly arcane rules, so regulators will back off once they realise some of the more disruptive effects that overly aggressive cybersecurity rules produce. However, the party leadership has shown a willingness to enact regressive policies, despite their recognisable downsides, especially when it comes to issues that are considered to be a matter of national security. Data flows and storage would fall into that category. If policies around cybersecurity, state security and core technologies are highlighted in the party report, it would be a strong signal that companies would need to brace themselves for significant policy tightening.

What is the attitude towards foreign investment?

Foreign investment flows have been in the headlines throughout 2017. Authorities have largely gotten a handle on capital outflows – both overseas direct investment and portfolio investment – but they are still concerned about the slump in inbound investment. If the desire to improve the foreign investment environment is well highlighted in the party report, then we will know that the intention, at least, is to continue to gradually open up and clarify existing investment rules. If the foreign direct investment environment is barely mentioned, then we would expect opening of the Chinese economy to proceed at a slower pace in coming years. Either way, these dynamics need to be considered by corporate boards making investment allocations across the globe.

Conclusion

The questions discussed above are just a few that companies should be asking themselves as the 19th Party Congress approaches. While the Chinese system remains opaque in many respects, the CPC does tend to signal its policy intentions. Moreover, policy formulation in China does follow certain processes, and that has been particularly true under General Secretary Xi Jinping–even if those processes have changed from previous administrations. Observers often describe a ‘sudden crackdown’ in this or that area, but for the most part, those ‘sudden’ moves are well signalled in advance by various party and government organs.

The Party Congress Report is the most high-level signalling document that the CPC has. General Secretary Xi must let his intentions be known to the millions of party-affiliated officials that he leads, and they are the report’s primary audience. The CPC won’t accomplish everything in the report, but there is no reason to mislead cadres, who will ultimately implement the report’s directives, about the party’s general aims for the next five years.

In general, we would expect that the policy direction for the next five years will not be too dissimilar from the past five. Many observers are optimistically hoping for a change of direction from General Secretary Xi starting next year. The argument is this: having fully consolidated power, the real reformer inside of General Secretary Xi can finally emerge untethered. We are highly sceptical of this expectation.

That does not mean that something truly unexpected will not emerge at the 19th Party Congress. A radical restructuring of the leadership structure would, of course, bear attention. Outside of such a move, we would look for any significant new policy priority to be given a billing in the work report. The new names on the Politburo Standing Committee will matter, but the developments that will truly affect foreign businesses in China will emanate from the words spoken at the party congress.

Andrew Polk is co-founder at Trivium/China. He was formerly director of China research at Medley Global Advisors and resident economist at the Conference Board’s China Center. Trivium is a team of policy and economy analysts telling stories that put today’s China in context and tomorrow’s China in focus.

Recent Comments