There is a peculiar, well-documented phenomenon that often occurs during countries’ development processes, whereby fast-growing, emerging economies begin to slow down just as they are reaching a level of wealth at which their citizens can truly start to enjoy the fruits of their labour. Looking back in history, international experience shows us that this slow down generally occurs well after countries pulled themselves out of poverty but before they graduate into the ranks of the rich economies — the phenomenon is thus dubbed ‘the middle income trap’ (MIT).

In the following article Bart van Ark, Chief Economist and Executive Vice President of the Conference Board, and Andrew Polk, Resident Economist at the Conference Board, discuss this phenomenon and examine how it could affect China or whether they could avoid it altogether.

What is the middle income trap?

When poor economies first begin to take off, they often do so propelled by a low-wage advantage. This allows the country’s manufacturers to offer competitive prices on the global market, since they have a lower cost base. However, as economic growth rates and productivity rise quickly, rapid wage increases tend to follow. Thus the trap is generally characterised by the fact that rising wages eventually begin to eat into the competitiveness that low-base wages originally offered.

Comparative studies show that competitiveness starts to erode in earnest — thus slowing headline economic growth — once a country reaches a level of per capita income that is still a fraction of a portion of the most advanced economies. While there is no clear-cut measure of the income level at which middle income traps occur, it seems reasonable to assume those traps can happen at roughly between 30-50 per cent of the average per capita income level of mature economies.

Around this level of income, which is somewhere in between USD 12,500 – 20,000 (purchasing power parity (PPP) adjusted) per year, the growth model which enabled the initial high-growth phase loses most of its steam. Rapid catching-up growth, characterised by adopting existing technologies from abroad and adapting them to the local circumstances, accompanied by low cost labour and rapid investment and increases in basic education of the labour force, dissipates.

Relative levels of labour productivity, US=100, 2012

Figure 1: As per capita income levels are much lower in many emerging markets there remains potential for catch-up before the middle income trap kicks in

Note: Labour productivity is measured as output per capita – PPP-converted

Source: The Conference Board Total Economy Database, January 2013 (https://www.conference-board.org/data/economydatabase/)

As economies get closer to the development frontier, the growth model becomes more complex. It is increasingly determined by innovation, investment in more sophisticated technologies and through the raising of the level and quality of education, notably secondary and higher education of the potential labour force.

The Asian Development Bank describes countries that cannot “compete with low-income, low-wage economies in manufacturing” and similarly are disadvantaged vis-à-vis “advanced economies in high-skill innovations”. In laymen’s terms: these countries cannot continue to compete on cost for cheap goods, and they cannot (yet) compete on quality for more sophisticated items. Due to a variety of factors, many countries risk getting stuck in this trap. As economic growth slows, it tends to not substantially outstrip growth in the population, thus average income does not budge, sometimes for decades.

How does this effect China?

China is rightly seen as a juggernaut. However, its recent growth is often wrongly seen as an unprecedented success story. Of course, because China has the largest population in the world, its development has been on a scale not previously seen. But the speed at which China’s economy has grown has been achieved before. Japan and South Korea are two very pertinent examples. To wit, China will have taken 21 years to quadruple its per capita income — an oft cited policy goal of the Chinese Government — from 1994 to 2015. However, Japan accomplished the same feat in 18 years, while Korea did so in 20 years. Hence while China’s growth model has many unique features, when taking a step back it is an economy like any other, with many of the same risks and opportunities. So, like any other economy that is about to change its growth model, does China run the risk of getting stuck in the MIT?

On an aggregate basis, China is still significantly below the level of per capita income that is typically associated with the MIT, standing at just over 20 per cent of USD per capita GDP, or roughly USD 10,000 (converted at purchasing power parity). However, because China’s economy is so large, the geography so disparate and the population so diverse, to obtain an accurate reading of China’s vulnerabilities (and strengths) one must dig deeper to uncover any clear pattern.

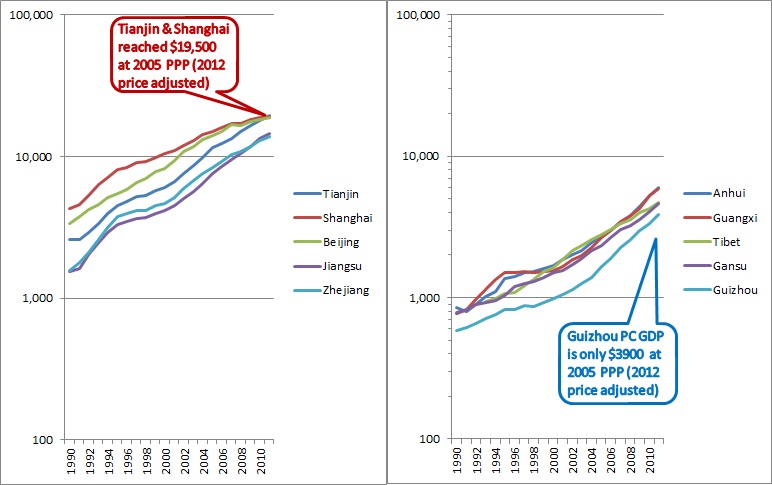

To this end, we looked at China’s regional breakdown of per capita income. Many of China provinces, or provincial-level cities, including Tianjin and Shanghai, have already reached a level just shy of USD 20,000 (PPP), which is at the top end of the MIT range. What’s more, the top five provinces — Tianjin, Shanghai, Beijing, Jiangsu, and Zhejiang — have all experienced rapidly decelerating economic growth rates since 2003, the point around which they would have entered the middle income trap range in full force. Meanwhile, as we might expect, China’s poorest provinces — Anhui, Guangxi, Gansu, Yunnan, and Guizhou — have all maintained per capita GDP growth rates averaging 10 per cent or more during that same period.

Figure 2: There are many different ‘Chinas’: Level of GDP per capita (PPP-based) – The richest five vs the poorest five provinces

Source: The Conference Board, Harry X. Wu

Putting everything together, we see a China that is clearly divided among high-, low-, and middle-income groups itself. Strikingly, many of the middle-income provinces are beginning to approach what some consider the first hump in the MIT[1] — at around USD 11,000 per capita (PPP) — while many of the richer provinces are approaching the second hump of USD 15,000 per capita (PPP). When looked at in this way, the possibility that China may begin to face pressures from the MIT sooner than expected becomes clear, particularly when one considers that the rich and middle-income provinces comprise the bulk of economic activity. In other words, if growth slows more substantially in those regions, fast-growing poorer economies will not be able to make up the difference and support overall economic growth — they simply don’t make up a large enough piece of the pie.

Can China avoid the middle income trap?

If China is further along the path to the MIT than most expect, as we posit, then the question remains: can China avoid the dangers associated with middle income status, and if so how? As we’ve mentioned, the primary reason that most economies fall prey to the MIT is rapidly rising wages — to the point that their manufacturers cannot compete. But getting stuck in a lower gear of growth is not a foregone conclusion, as many countries have attested to. Most importantly, economies can offset the effects of higher labour costs by increasing the productivity of their workers and investing in technological innovations that allow for greater efficiency in production. Said another way, to beat the MIT China needs to focus on human capital and innovation.

To date, much of China’s growth has been enabled by a rapid shift of labour from agriculture into the manufacturing sector. Moving workers from less productive farming activities — particularly on small plots of land that don’t enjoy economies of scale, as is typically the case in China — to more productive pursuits in the manufacturing realm, makes for relatively easy gains in growth simply by putting the labour force to use in a more efficient way.

Another major source of recent Chinese growth has come from catch-up growth, which has led China to quickly integrate (nearly) global best practices and technologies into its production processes. By obtaining investment and know-how from the rest of the world, many companies in China have quickly narrowed the technology gap. A good number of firms are using world-class production processes, therefore improvements in efficiency become much more difficult to come by.

As such, China has begun to exhaust many of the ‘easy’ gains that have propelled growth in recent years, and as a result many sectors in the economy are beginning to experience symptoms associated with the MIT. In order to forestall a prolonged growth slowdown, Chinese companies and policymakers will be forced to focus on producing the more difficult gains that come from innovation and human capital investment, which drive productivity growth in a more sustainable way. To date, Chinese investment in fixed capital has been highly inefficient, leading to ever-lower returns. What’s more the service sector of the economy is still underdeveloped and the educational system, while improving, often struggles to produce highly-skilled workers. Rectifying these challenges will require significant policy changes throughout the economy, from fiscal and financial reform, to re-tooling SOE governance, to more socially-linked areas like the household registration (hukou) system that hampers labour flexibility by disadvantaging migrant workers.

These reforms, while large in scale and difficult to enact, would help to unlock some of the latent productivity in the economy, by boosting returns on human capital and creating an environment in which firms could more readily innovate. That jolt to productivity growth would be the key to offsetting rising wages and continue to meet higher income expectations. Because such fundamental reforms are difficult, many economies have struggled to make the necessary adjustments and succumbed to declining competitiveness leaving them for longer in the MIT than necessary. For China, there is still time to beat the MIT, but in order to do so policymakers and businesses will need to shift focus now.

The Conference Board (TCB) is a global, independent business- membership and research association, started in 1916, working in the public interest. Their mission is to provide the world’s leading organisations with the practical knowledge they need to improve their performance and better serve society.

Their membership includes over 1,200 companies in both the established and the emerging markets of the world, and they provide objective economic data and analyses that help business and policy leaders make sense of their operating environments.

[1] Eichengreen, Barry; Park, Donghyun; Shin, Kwanho, 2013, National Bureau of Economic Research Working Paper Series, Growth Slows Down Redux: New Evidence on the Middle-Income Trap

Recent Comments