Coinciding with Europe Day on 9th May, the European Chamber of Commerce in China hosted its inaugural annual conference, attended by distinguished guests and featuring a diverse collection of expert panellists from government, industry and academia.

Coinciding with Europe Day on 9th May, the European Chamber of Commerce in China hosted its inaugural annual conference, attended by distinguished guests and featuring a diverse collection of expert panellists from government, industry and academia.

The conference theme provided the perfect backdrop for some serious discussion on China’s future reform challenges and the increasingly important role it will play in the world. Panellists provided thought-provoking, incisive commentary on all of the big issues, such as urbanisation and demographics, social, political and economic reform, and how China will help to shape the world. These themes were set against a context of the varied roles that European businesses and institutions can play in helping China to achieve its long-term goals.

The presentations and skilfully-moderated panel discussions were open, frank, engaging and genuinely insightful.

Carl Hayward provides an overview of the event, and emphasises some of the key themes that emerged.

The information provided below is taken from the personal opinions of conference participants and do not necessarily represent the views of the Chamber. Actual quotations have not been attributed as the Chatham House rule prevailed in order to facilitate a more honest and open dialogue throughout the event.

EU-China relations still strong

EU-China relations still strong

The conference was opened with speeches delivered by Dr Markus Ederer, Ambassador Head of Delegation, Delegation of the European Union to the People’s Republic of China and Mongolia, Sun Yongfu, Director General, Department of European Affairs, Ministry of Commerce and Jens Reubbert, Vice President of the European Chamber.

The conference was further supported by a keynote speech delivered by Wei Jianguo, Secretary General of China International Economic and Exchange Centre and former Vice Minister of the Ministry of Commerce.

It was encouraging to hear, from both European and Chinese sides, recognition of the value of the trade partnership between the EU and China, a genuine commitment to continued cooperation and development and a call to move away from protectionism and focus on the bigger picture of strengthening trade relations. It was also gratifying to hear glowing support for the Chamber and the role that we play in facilitating dialogue between industry and government in furthering these goals.

It was encouraging to hear, from both European and Chinese sides, recognition of the value of the trade partnership between the EU and China, a genuine commitment to continued cooperation and development and a call to move away from protectionism and focus on the bigger picture of strengthening trade relations. It was also gratifying to hear glowing support for the Chamber and the role that we play in facilitating dialogue between industry and government in furthering these goals.

Appreciation was also shown for the Chamber’s study Chinese Outbound Investment in the European Union in bringing balance to the EU-China relationship by focussing on the role that Chinese investment plays in the EU.

Collaboration is key

The global information technology and communications (ITC) market is developing at break-neck speed and competition has become fierce, but there is common ground that requires collaboration between competitors.

Each person will be downloading, on average, one gigabyte of information per day by 2020. The current capacity of the technology that deals with information flow will need to be increased by a factor of 1,000 in order to cope with this demand. The technology to store and process this data in real time also needs to be vastly improved.

Each person will be downloading, on average, one gigabyte of information per day by 2020. The current capacity of the technology that deals with information flow will need to be increased by a factor of 1,000 in order to cope with this demand. The technology to store and process this data in real time also needs to be vastly improved.

The telecoms industry is, by definition, global, and this requires the adoption of global standards of technology. Only when this occurs will the market be successful.

There is also need for European companies to meaningfully contribute to China’s energy consumption and environmental challenges. In order for this to take place companies in this sector need to feel encouraged to increase their investments in China, yet the current regulatory environment and restrictions to market access are not giving companies the confidence to do so.

These challenges can be met through collaboration. This requires open dialogue between companies in order to resolve issues of competition, but government reforms are also urgently required in the area of market access and to the regulatory landscape. There is also a need for more government attention to be placed on protection of intellectual property rights.

China’s influence will continue to grow

China’s influence will continue to grow

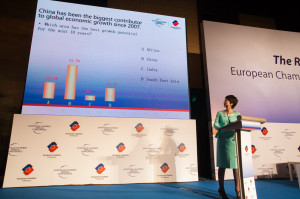

China’s increasingly dominant position in the world economy means that it will inevitably shape the world in greater ways. Improved spending power amongst Chinese will force industries to adapt more of their products and services to suit Chinese tastes, but at the same time, as Chinese people travel and become more internationalised, there will also be a convergence between the way that Chinese and Westerners consume.

European companies should bear in mind that they need to view China in local terms rather than treating it as one country, as it is a fragmented marketplace. The way that people consume in Beijing is not the same as Shanghai, Shenzhen or Chengdu, and products must be developed accordingly.

China’s laudable behaviour during the Asian financial crisis of 1997 suggests that their ineluctable rise to becoming the top economic power in the world will be dealt with responsibly. As one panellist pointed out, over the last 30 years China has benefitted from the financial systems and market rules that were created by the West, and they are not about to shoot themselves in the foot and alienate themselves. They have to take a responsible global role.

It was also emphasised that Chinese companies who wish to develop more soft power need to cultivate more deals that are win-win.

Social challenges abound

Social challenges abound

China currently has an urban population of 710 million, of which 250 million have no hukou, meaning they have no access to social benefits. Every year eight to 16 million more people flow into cities, raising the question: what model of urbanisation should be adopted?

Food security is also a challenge—seven per cent of arable land was lost to urbanisation last year alone—and there needs to be an increase in productivity as increasing the acreage of arable land is not sustainable.

Pollution is another major problem, as larger urban populations burn more energy and produce more waste. As the density of China’s cities increases, they need to look at European models and learn how to move towards lower-carbon cities and deal with water treatment more effectively. It was emphasised that, on the issue of urbanisation, there is a strong axis between China and the Europe through the European Chamber’s Working Groups that can be drawn upon.

China’s population is rapidly ageing. In 30 years one in four people will be over 65 and the ratio of tax payers to benefit receivers will go from 5:1 to 2:1. It was suggested that increasing the retirement age would present a huge opportunity and that perhaps the one-child policy should be revised.

Pension systems require reforms and the healthcare system is under increasing strain due to a lack of primary healthcare. Above all there needs to be reforms to avoid social unrest amongst the cities’ urban migrant populations. Hukou reform is urgently required, with one panellist suggesting that the system should be abandoned altogether.

Financial reforms will drive future growth

Financial reforms will drive future growth

Although financial reform is key, over the last 30 years it is perhaps the area that has lagged behind all others. It was suggested that the last 10 years were something of a ‘lost decade’, and that it isn’t so much that financial reforms stalled, rather they actually went backwards. However the last decade is in the past and China must move forward.

What should be done to reform the financial system and what will actually be done, though, are two very different things, and people should lower their expectations. It is likely that the bad assets that have accumulated over the last decade—mainly through loans that are backed by local governments—will begin to appear on the balance sheets of banks. This could trigger a fiscal crisis, although it was emphasised that this would probably not be on the scale of Europe’s.

The worst case scenario is that moving forward there will be little or no financial reform. One panellist expressed the view that under the NDRC there will be no development and no reform, and that in order to progress there needs to be a taskforce, independent of the state council, that drives change.

Necessary reforms are being ignored because they cause pain. According to one panellist, financial reforms now are 100 times more difficult than they were under Deng Xiaoping. This was attributed to Deng’s decisiveness, when compared to the government of the last decade, and also because these days groups with vested interests are greater in number and wield much more power.

There appeared to be a general consensus that financial reform will not be considered to have taken place until there has been a reform of state-owned enterprises (SOEs), who one panellist referred to as “too powerful, too aggressive and too inefficient.” SOEs produce an uneven playing field, do not allow fair competition and demoralise the private sector. The government should reduce SOEs to less than 10 per cent in order for China to be called a market economy.

There appeared to be a general consensus that financial reform will not be considered to have taken place until there has been a reform of state-owned enterprises (SOEs), who one panellist referred to as “too powerful, too aggressive and too inefficient.” SOEs produce an uneven playing field, do not allow fair competition and demoralise the private sector. The government should reduce SOEs to less than 10 per cent in order for China to be called a market economy.

The other issue that was put forward as a key condition for financial reforms to take place was the rule of law, and this must be addressed as the new leadership moves forward.

Overall the conference was a resounding success and we would like to take the opportunity once again to thank our distinguished guests, speakers and all who attended. We would also like to extend a special thanks to the conference sponsors.

Recent Comments